Asia Pacific

Participate in Asia’s growth with a different perspective.

The Asia Pacific region encompasses a diverse collection of countries with a multitude of cultures and languages. We make regular research trips across the region and incorporate these on-the-ground observations into our company analysis. We believe this makes us better-informed investors, with different perspectives to the crowd.

What we invest in

Dominant consumer franchises

With favourable demographics and populations that are still growing – particularly in Southeast Asia and India – we believe dominant consumer franchises can offer good growth potential over the long term.

Rise in healthcare spending

Many countries are under-invested in healthcare compared to the global average. As these economies become richer, we expect healthcare and health-related spending to rise.

High quality financials

We believe banks and high quality financials should benefit from similar drivers as consumer businesses: demographics, rising incomes and urbanisation.

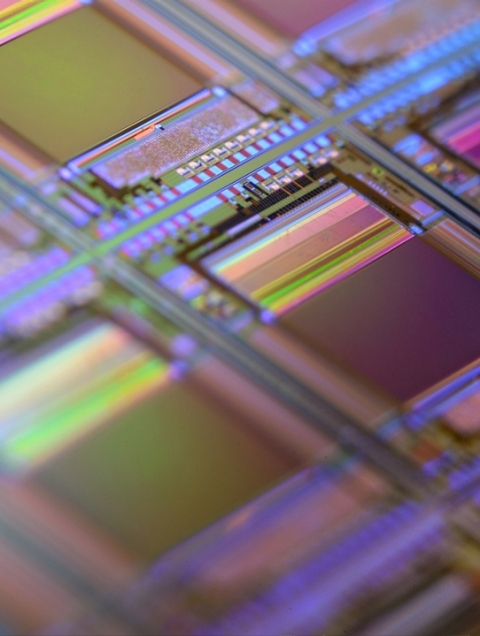

A more connected and automated world

As the world embraces a digital future, we believe Asian technology firms should benefit from strong end demand and a growing market. At the same time, lower-cost robots allows manufacturers to automate their processes.

Our approach to responsible investment

Non-label disclaimer

Our approach to responsible investing has been shaped by an emphasis on stewardship and the belief that quality managers and good governance should ensure that environmental and social concerns are rightfully addressed. We have integrated sustainability analysis into our investment process and engage extensively on environmental, labour and governance issues.

Sustainable investment labels help investors find products that have a specific sustainability goal. FSSA's products do not have a UK sustainable investment label as they do not have a non-financial sustainability objective. Their objective is to achieve long-term capital growth by following its investment policy and strategy.

Meet the managers

Martin Lau

Managing Partner

Rizi Mohanty

Portfolio Manager

Sreevardhan Agarwal

Portfolio Manager