Asia Pacific

Participate in Asia’s growth with a different perspective.

The Asia Pacific region encompasses a diverse collection of countries with a multitude of cultures and languages. We make regular research trips across the region and incorporate these on-the-ground observations into our company analysis. We believe this makes us better-informed investors, with different perspectives to the crowd.

What we invest in

Dominant consumer franchises

With favourable demographics and populations that are still growing – particularly in Southeast Asia and India – we believe dominant consumer franchises can offer good growth potential over the long term.

Rise in healthcare spending

Many countries are under-invested in healthcare compared to the global average. As these economies become richer, we expect healthcare and health-related spending to rise.

High quality financials

We believe banks and high quality financials should benefit from similar drivers as consumer businesses: demographics, rising incomes and urbanisation.

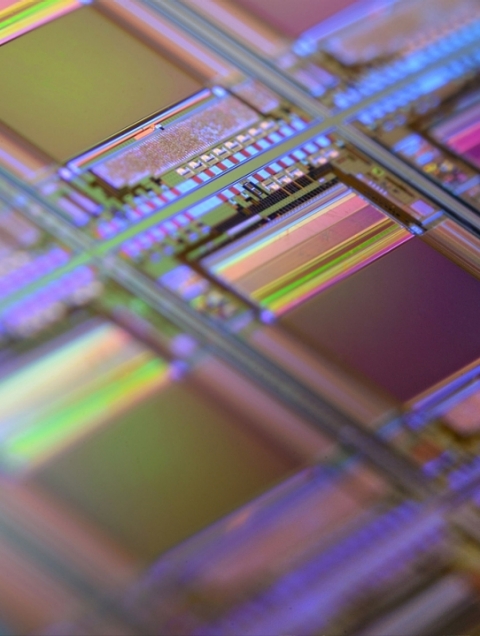

A more connected and automated world

As the world embraces a digital future, we believe Asian technology firms should benefit from strong end demand and a growing market. At the same time, lower-cost robots allows manufacturers to automate their processes.

Our approach to responsible investment

Non-label disclaimer

Our approach to responsible investing has been shaped by an emphasis on stewardship and the belief that quality managers and good governance should ensure that environmental and social concerns are rightfully addressed. We have integrated sustainability analysis into our investment process and engage extensively on environmental, labour and governance issues.

Sustainable investment labels help investors find products that have a specific sustainability goal. FSSA's products do not have a UK sustainable investment label as they do not have a non-financial sustainability objective. Their objective is to achieve long-term capital growth by following its investment policy and strategy.

Meet the managers

Martin Lau

Managing Partner

Rizi Mohanty

Portfolio Manager

Sreevardhan Agarwal

Portfolio Manager

Price & performance

Strategy overview

Issuer:Key facts

ASX announcements

The iNAV reflects the estimated NAV per unit in respect of the Fund’s assets that have live market prices during the trading day. The issuer of the Fund has engaged ICE Data Indices, LLC as iNAV calculation agent to independently calculate the iNAV.

* iNAV calculations as shown (the "data") are provided by ICE Data Indices, LLC or its third party suppliers and are updated during ASX trading hours. iNAV calculations are indicative and for reference purposes only. The Fund is not sponsored, endorsed, sold or marketed by ICE Data Indices, LLC, its affiliates ("ICE Data") and ICE Data or its respective third party suppliers MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE iNAV, FUND OR ANY FUND DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, DIRECT, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. You acknowledge that the data is provided for information only and should not be relied upon for any purpose.

Strategy Overview

This Fund is an Irish domiciled UCITS fund marketed in the UK under the Overseas Fund Regime (OFR). The Fund is not subject to the UK sustainability disclosure and labelling regime.

Key Facts

Exit Price:

Price Date:

Issuer:

* This is an annualised interest rate from the past seven days. For actual performance for our Cash Funds, please view the performance page.

Issuer:

Strategy Overview

Key Facts

Performance returns are calculated net of management fees and transaction costs. Performance returns for periods greater than one year are annualised. Past performance is not a reliable indicator of future performance.

Investment Resources

For more information, please contact us.

Ready to invest?

Find out how you can invest with us