Asia Pacific Equities: Fund Manager Q&A

In response to recent questions from our clients, we had a conversation with Martin Lau, managing partner and lead portfolio manager for a number of FSSA strategies, covering Asia and Greater China

Asia Pacific Equities

Can quality growth stocks outperform when consumer sentiment is weak?

We continue to believe that high-quality companies often turn out to be the best long-term investments. This view became more popular (up until two or three years ago), when interest rates were held at zero. Many investors overpaid for such companies, especially consumer businesses across the Asia region.

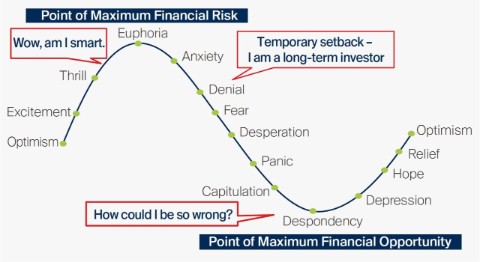

As quality growth companies became expensive, and interest rates started rising along with commodity prices and oil prices, commodity stocks outperformed and quality companies lagged. This divergence in performance, or reversion to the mean, is typical for stock market cycles — and has been happening for the past few years.

However, when it comes to investing, the longer the time horizon, the more important are the people, the business franchise and the financials. Less important are cycles, interest rates, Gross Domestic Product (GDP) growth, etc. As long-term investors, we still seek out quality growth companies for our portfolios, even though they may perform less well over shorter time periods because of market forces or negative sentiment.

What are your views on China’s slowing growth?

Over the many years that I have looked at China and other markets, every market, country or economy has a cycle. China is undergoing a difficult cycle because the property bubble has burst and also because of negative sentiment around geopolitics and regulations. There are usually signs of exuberance which mark the peaks of cycles, and signs of giving up which signal the troughs.

Rather than trying to time the cycle, we focus on investing in quality companies. For example, almost every company in our portfolio has a net cash balance sheet, a proven business model, cash-flow generation, and high returns on capital employed, which allow these companies to withstand a relatively tough economic cycle. And when the valuations become very cheap or attractive enough, we would add to these positions, as we have done in the past year.

The other thing we want to see is how companies would respond to an especially difficult economic period, for example, looking to return more cash to shareholders. In my view, observing the attitude and actions of companies’ management is more important than trying to time the trough of the cycle, which only becomes clear after the fact.

How do you see China vs India?

I think India is quite special. First of all, there are many companies which have a long history of being listed, like HDFC Bank or Godrej Consumer. We have been shareholders in them for a long time and have been very impressed by the management quality.

Generally speaking, the companies in India have many of the qualities we like. Chinese companies seem to be more focused on growth, whereas Indian companies are more focused on returns. But one concern is that valuations in India are getting more expensive, so the stocks could be prone to a correction.

Another difference compared to China — for example, Godrej Consumer’s annual revenue is around USD1.5 billion. Compare that to a consumer company in China, for example China Mengniu, its revenue is about USD15 billion a year, or ten times the size1.

For China, the concern is that it has become very big and therefore growth is going to be slower. Considering the lower valuations, it’s debatable whether this low growth has been priced in. For India, the investment case is that the base is pretty low, which suggests more potential for growth, but the PE (price-to-earnings) ratio is high.

What are your views on HDFC’s recent volatility?

We talked about how we like quality companies with strong management, and HDFC Bank belongs to this category. We have been shareholders in HDFC Bank2 for many years. Under the previous CEO, Mr Puri, it became the leading privately-owned bank in India. For the last 10-15 years, the track record has been phenomenal.

Source: Factset, FSSA Investment Managers, March 2024. Investment involves risk. Past performance is not indicative of future performance.

We believe the growth will continue, but it’s no longer a small bank, so the future growth is going to be less strong compared to before. We believe it can still generate 10-15% EPS growth in the future. But for the last 20 years it was more than 20%. So the growth will likely slow down.

Another thing, which is more short term — because of the recent integration with the parent HDFC Corp, there's a need to deleverage the balance sheet, because HDFC Corp had a wholesale-funded mortgage book. But currently, liquidity is tight in India. So to deleverage the balance sheet, HDFC Bank would need to compete for deposits, and I think the market is concerned about how this could affect growth.

That said, we believe the best time to buy a high-quality company is when it is cheaper and going through a difficult period, which is the case with HDFC Bank. For investors with a 3-5 year horizon or longer, we believe it is an attractive investment.

How are you investing in artificial intelligence (AI)?

Rather than trying to make predictions on leading-edge technology, we usually approach it in a simpler way. We have been invested in Taiwan Semiconductor (TSMC)3 for many years, because it produces an integral part of the AI supply chain — in other words, the most advanced chips developed by Nvidia, AMD, MediaTek and others. So we see it as a good company with a strong franchise and competitive edge in the leading technologies.

In terms of AI’s potential, it is a big debate. Recently I read a report which said it's going to help banks to save expenses, help drug development because it's much smarter, help fund management because it can do a lot of the analysis for you, etc.

I believe it would need to expand into more day-to-day applications. We like companies like MediaTek or Samsung4 because for AI to be sustainable, there needs to be more applications which can increase profits for companies, such as smartphones or automobiles which use AI. I think AI will help us become more connected, becoming ingrained in consumer interfaces and used in more applications.

One area it could impact is general productivity. We are invested in automation companies like Keyence and Advantech5. Before AI happened, it made communication much easier with 5G. And with that, it became easier to control a robot compared to 3G and 4G. So I think AI would be another catalyst for automation as the world is running short of labour.

How do you view Japan stocks in the context of the regional portfolio?

We have been investing in Japan for more than 10-15 years. Japan is interesting because the economy has been bad for so long. For any companies to have survived three decades of recession or deflation, that speaks to the management ability and balance sheet strength.

Another interesting aspect of Japan is that there are many niche companies which focus on very specific products. For example, SMC is a leader in pneumatic components and has this singular focus. Likewise, one of our first investments into Japan was a company called Pigeon, which focuses on infant milk bottles and related products6.

So the detail-oriented mentality and culture is something that intrigues us. One of the major areas that we're invested in is automation. Keyence has been one of the largest positions in the FSSA's Strategy for a number of years, because it’s strong in optical sensors in the automation space. It has a very strong track record and financial performance.

We also like the creativity among companies in Japan. For example I grew up with Mario Brothers from Nintendo. There are many of these likable characters which are intellectual properties (IPs) in Japan, which I think is quite unique. Hello Kitty is another example, and Street Fighter from Capcom7.

In my view, Japan is complementary in a regional portfolio because if you believe in China’s automation, you may find the leading automation companies are actually Japanese, and better-positioned to benefit from this trend. Similarly, if you look for leaders in hardware, you might consider TSMC in Taiwan. If you want to find a leader in content or IP, you can consider Nintendo in Japan. In our case, we own Sony Group, which has Sony Music, Sony PlayStation games, and is a leader in CMOS image sensors.

What makes FSSA unique among asset managers?

Our team has a very strong culture and a strong belief in our investment philosophy. Many fund managers may say they invest in good companies and are long-term investors, but we really practice this. For example, our portfolios typically have very low annual turnover, like 15-20%. In addition, I spend most of my time researching companies. So this passion for finding good companies and holding them for the long run is very unique in my view.

Finally, we will actively engage with the companies we invest in, because we believe being long-term shareholders comes with certain responsibilities. Just before this meeting, I was writing a letter to a portfolio company because of certain engagement issues, so we don't just delegate it to other people.

Can you comment on the recent performance of FSSA’s Asia and China strategies?

Last year, the performance in relative terms has been disappointing. A number of the high-quality companies, which are long-term holdings in our portfolio, were derated from relatively high levels. Whereas some of the commodity shares, such as CNOOC and Petrochina (which are actually on the US sanctions list), performed very well8.

This is not good excuse, but it needs to be put into context. We believe our longer-term performance is still solid. Perhaps more importantly, we haven't changed our investment philosophy or portfolio. We are still holding on to the same investment process, the same companies, the same management teams which we want to back. We hope our clients will share the same philosophy as us, and believe in these companies for the long run.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same.

1 These are two randomly-chosen large consumer companies in their respective countries (which FSSA owns), to illustrate the different in size.

2 HDFC Bank was a common question related to FSSA’s India allocation so included here.

3 TSMC is the largest position in FSSA’s regional funds which has exposure to the AI trend.

4 These are two other large holdings in FSSA’s regional funds which have exposure to the AI trend.

5 Keyence and Advantech are randomly-chosen examples of companies with businesses in factory automation (which FSSA owns).

6 SMC and Pigeon are two randomly-chosen examples of Japanese companies which focus on single products (which FSSA does not own).

7 Nintendo and Capcom are randomly-chosen examples of Japanese companies with strong intellectual properties, like well-known video game characters (e.g. Mario Brothers and Street Fighter). FSSA does not own either company.

8 CNOOC and PetroChina are two large Chinese state-owned oil companies whose stocks were strong last year, but not held in FSSA funds.

Important Information

This material is solely for the attention of institutional, professional, qualified or sophisticated investors and distributors who qualify as qualified purchasers under the Investment Company Act of 1940 and as accredited investors under Rule 501 of SEC Regulation D under the US Securities Act of 1933 (“1933 Act”). It is not to be distributed to the general public, private customers or retail investors in any jurisdiction whatsoever.

This presentation is issued by First Sentier Investors (US) LLC (“FSI”), a member of Mitsubishi UFJ Financial Group, Inc., a global financial group. The information included within this presentation is furnished on a confidential basis and should not be copied, reproduced or redistributed without the prior written consent of FSI or any of its affiliates.

This document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results. This material is provided for information purposes only and does not constitute a recommendation, a solicitation, an offer, an advice or an invitation to purchase or sell any fund and should in no case be interpreted as such.

Any investment with FSI should form part of a diversified portfolio and be considered a long term investment. Prospective investors should be aware that returns over the short term may not be indicative of potential long term returns. Investors should always seek independent financial advice before making any investment decision. The value of an investment and any income from it may go down as well as up. An investor may not get back the amount invested and past performance information is not a guide to future performance, which is not guaranteed.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon First Sentier Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Actual returns can be affected by many factors, including, but not limited to, inaccurate assumptions, known or unknown risks and uncertainties and other factors that may cause actual results, performance, or achievements to be materially different. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and First Sentier Investors undertakes no obligation to publicly update any forward-looking statement.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE.

Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of FSI.

For more information please visit www.firstsentierinvestors.com. Telephone calls with FSI may be recorded.

Read our latest insights

- Article

- 6 mins

- Article

- 8 mins

- Article

- 8 mins