Discerning value amid China’s macro noise

“Whenever you find yourself on the side of the majority, it is time to pause and reflect.” 1

Mark Twain

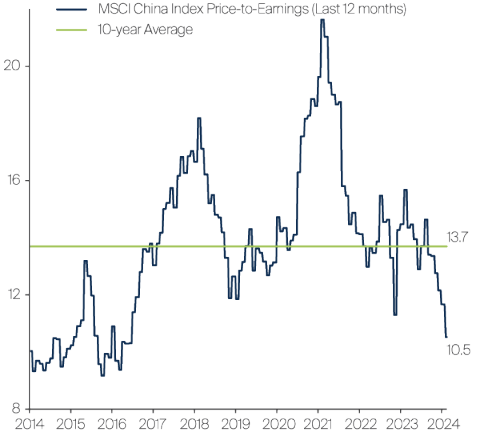

When China reopened at the end of 2022, domestic stocks had a V-shaped rebound, analysts raised their earnings forecasts, and companies prepared for a steep recovery in the economy. But the market’s optimism soon faded and turned into disappointment. Consumers did not return to pre-Covid levels of spending, and companies overinvested in new capacity and inventory. Mismatches between demand and supply led to increased competition in many sectors, along with price cuts and deflation. Adding to the pessimism were media reports of tightening regulations, rising unemployment, falling birth rates, property company defaults and tensions with the West. On the back of these concerns, the China market’s valuations fell back to low levels.

MSCI China Index valuations vs the past decade

Source: Factset, FSSA Investment Managers, as at 14 February 2024.

Source: Factset, FSSA Investment Managers, as at 14 February 2024.

However, from our perspective as fundamental, bottom-up investors, the picture was more mixed. Since the borders reopened at the start of 2023, members of the FSSA team have visited China regularly to meet with companies. China’s overall consumption did not return to the pre-Covid levels, and we were surprised by the level of competition in certain industries, but some segments posted decent recoveries which were often overlooked amid the pessimism. Many companies still benefited from premiumisation, import substitution, and more capital discipline. Many also continued to upgrade their research and development (R&D), ESG and management capabilities.

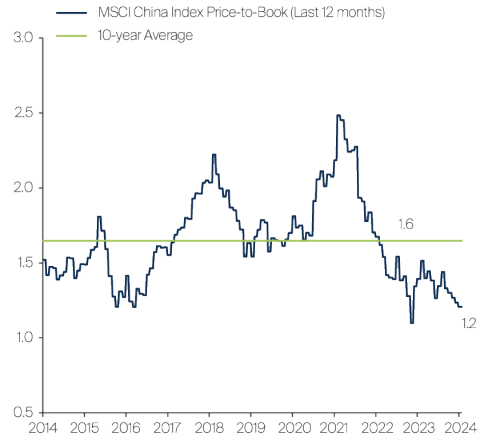

We recently visited Midea Group’s headquarters in Shunde, a southern city near Shenzhen with 2.5 million people. Midea is China’s largest home appliances company and a long-term holding in our portfolios. It had de-rated sharply from its peak in late 2020, even as its earnings continued to grow, before the stock price stabilised in 2023.

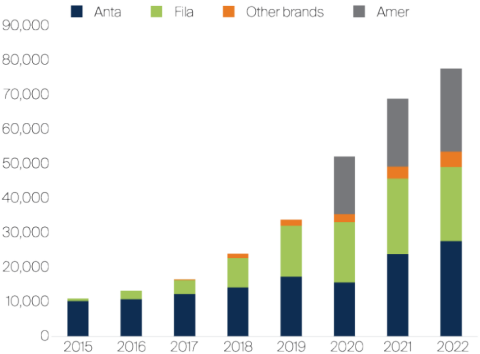

Midea’s has shown steady earnings growth but valuations can swing on sentiment

Source: FactSet, FSSA Investment Managers as at 14 February 2024.

During our visit, we saw the company’s logo on buildings all around us and felt its ubiquitous presence in the city. Most Chinese families already own home appliances, and volumes have plateaued in all three of the large categories (air conditioners, refrigerators and washers). The domestic appliances market has become an oligopoly with Midea, Gree and Haier Smart Home holding 60% market share, vs 48% a decade ago. In this mature but more consolidated market, Midea remains no. 1 or no. 2 in every major category, with replacement demand being the dominant driver.

The appliances market is seeing some polarisation, with the high end and low end growing better than mid-range products. While China’s demographic tailwinds are not as strong as before, Midea has invested substantial sums in product development to differentiate its high-end offerings in brands like Colmo, and to take the Midea brand up-market. While like-for-like pricing is declining slightly, this is being off-set by mix improvement. Overall, Midea intends to maintain its healthy operating margins.

Midea’s high-end appliances (left) and KUKA robotic arm (right)

Source: FSSA Investment Managers, as at January 2024.

Source: FSSA Investment Managers, as at January 2024.

In addition, Midea has been focusing on its B2B business, and aims to become a technology company. The company’s automation level doubled to 80% from 2019 to 2023, resulting in cost reductions every year. A small but growing part of its business is KUKA, a German robot maker which Midea acquired in 2016. It makes more than 80% of the robotics in Tesla’s new Shanghai factory and the BYD auto factory. Its traction among automakers is well-aligned with China’s growing leadership in this area. While the margins here are still low, we think it shows the company’s forward thinking.

Our trip reassured us on Midea’s moat and culture. The company has more than 30 R&D centres and manufactures in 19 cities globally. Despite its large scale and mature growth profile, the operations are efficient, profitable and highly cash-flow generative. Even after factoring in the beleaguered property market and economic uncertainties, we believe 8-10% annual profit growth may be achievable in the coming 3 years.

Besides being the dominant domestic player, around 40% of Midea’s sales come from exports, mostly contract manufacturing. As China’s market becomes more mature and competitive, more domestic companies may aim to go overseas. However, this is challenging in practice, so Midea’s success in the global arena speaks to its quality.

Leading consumer companies at lower valuations

Midea is well-positioned to benefit from China’s rising income levels and the premiumisation trend, but a key concern among investors these days is consumption downgrading, or “down-trading”. This is understandable given the negative wealth effect from the declines in China’s property and stock prices, along with high unemployment. However, there were areas where we saw solid demand for premium products. The key difference is that Chinese consumers have become more discerning in their tastes and conscious of value for money.

We have a large weighting in several consumer companies, including Anta Sports, China Resources Beer and China Mengniu Dairy. These are industry leaders which usually traded at higher multiples than their peers, but were de-rated in the past year. While the market seems to think consumption downgrading is a structural trend, we see it as more of a cyclical headwind. In our view, many companies’ valuations were mispricing their growth potential, so we used this opportunity to add to these high-conviction holdings.

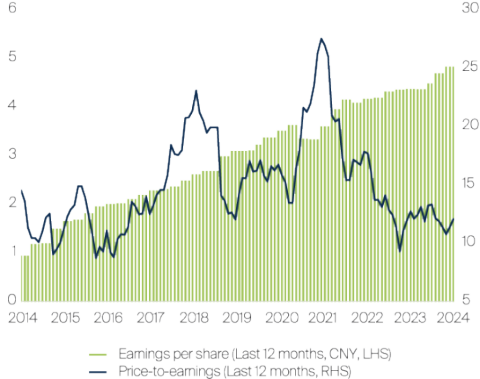

Building a house of brands

Anta Sports was founded in 1991 by Fujian native Ding Shizhong, whose entrepreneur journey started with buying and reselling shoes from his father’s factory. Ding realised early on that having a strong brand could enable premium selling prices. Over time, Anta has become the only major Chinese sportswear company to successfully grow multiple brands in different categories, such as FILA for high-end fashion sportswear and Anta for the mass market.

In 2019, Anta further moved into the high-end sports market, expanding its brands by purchasing the Finnish company Amer Sports which owned well-known brands such as Salomon, Arc’teryx, Atomic, Wilson, and Peak Performance. This enabled Anta to cover all sportswear categories — performance, fashion and outdoors. Anta also acquired Descente, the high-end Japanese winter sports company, and Kolon Sport, the Korean outdoor-wear brand.

Track record of growing sales with multiple brands (CNY, million)

Source: Wind, Euromonitor, Nomura, J.P. Morgan, FSSA Investment Managers as at 14 February 2024. Uses fully consolidated revenue for Amer.

While still a family-run and majority-owned company, Ding has brought in outsiders to take Anta to the next level. We believe this combination of long-term owners and well-aligned managers, including high-profile hires from Nike, Reebok and Lululemon, has been key to Anta’s success.

More recently, weak consumer demand has been a headwind for the stock, but Anta reported impressive performance at its recent update. Its higher-end brands like Fila, Descente, and Kolon all saw strong sales growth in China during 2023, ranging from high-teens growth for Fila to 60-65% for the other two. This contrasted with the performance of its large domestic peers, which struggled with excess inventory and discounting. The company’s operating margins also improved during the year.

As the company becomes more multi-brand, it is also encouraging to see a strong layer of leaders below the top management. We were impressed by the new Anta brand CEO, Xu Yang, who sounded confident in targeting double-digit sales growth over the next 3 years, which implies acceleration from high single-digit growth in 2023.

Amid the recent encouraging developments, we added to our position at lower valuations. We think Anta’s structural growth thesis is intact, with its house of brands growing and the company entering overseas markets. And in these difficult times, it is important to back the right people.

A leading global brand adding Chinese distribution

China Resources Beer (CRB) is the largest beer company in China with around 30% market share, and its mass-market Snow brand is the world’s largest by volume. CRB has also faced a challenging environment with down-trading pressure, as fewer people seem to be eating out at venues where premium beverages are typically consumed. In the past, the management was able to raise prices across the entire product range, but recently only the products with stronger value proposition or brands have been doing well. On the other hand, we remain optimistic about CRB’s growth potential.

China’s beer market is different from global markets, as volumes have been in decline since 2014. Despite this hurdle, we bought CRB in 2017 as we expected the company to benefit from the premiumisation trend, given its competitive operations. This has been playing out so far — CRB’s share of premium sales has grown to around 20% of turnover, with help from a 2019 merger with Heineken China, and could increase to 25% by 2025.

China is now Heineken’s second largest market, and it has gained traction in several large coastal provinces, but we think it can continue to gain share — its volume is only 30% of Anheuser Busch’s Budweiser. The brand only officially went nationwide in 2023, and can benefit further from CRB’s extensive sales network. Its volume is expected to grow more than 30% per annum for the next few years, after surpassing 50% growth in 2023.

CRB’s chairman and CEO, Hou Xiaohai, is a passionate and hands-on leader with a clear strategy, focusing on quality growth and profitability in a consolidating industry. His longer-term initiatives include entering the Chinese liquor business with last year’s Jinsha acquisition, and marketing healthier drinks, such as non-alcoholic beverages to target younger people.

Quality dairy products for health-minded consumers

As the Chinese population grows older and richer, nutrition is becoming a greater priority. China Mengniu Dairy is another holding which has faced negative headwinds over the consumption slowdown, but like CR Beer with Heineken, it has a strong premium product — Milk Deluxe, a well-known brand of ultra-high temperature (UHT) milk.

Milk Deluxe has a strong value proposition, using only the highest-quality raw milk from dedicated ranches. It contains more protein than basic milk, and the taste is richer and creamier. Mengniu and key competitor Yili combined have spent over RMB50bn in the past decade to promote premium UHT milk, so Chinese consumers recognise the Milk Deluxe brand. Thus it can garner a premium of 50-400% over basic milk.

Mengniu’s profit growth has been driven by the liquid milk business, where UHT milk is the biggest and fastest-growing part. This business favours economies of scale, and the barriers to entry from upstream milk sourcing, marketing spend and channel coverage make it nearly impossible for smaller players to compete. Mengniu and Yili each hold 40-50% of China’s UHT milk market. There is also a trend of continuous premiumisation within UHT milk, and Milk Deluxe holds over 50% market share in premium UHT milk.

Milk Deluxe has delivered 20% compound annual growth rate (CAGR) over 10 years, contributing 30% of Mengniu’s total 2022 revenue, and is highly profitable within Mengniu’s product lines. We believe Milk Deluxe will continue to outgrow the market, given the growing focus on health and wellness in China. However, the company will need to continually upgrade the product quality and value proposition in this weak consumption environment.

Having first bought Mengniu’s stock in 2004, we have been meeting with the management regularly ever since. Amid the market’s pessimism, our recent meetings with CEO Jeffrey Lu have added to our conviction. Since he took office in 2016, he has been consistent in executing Mengniu’s long-term strategy — launching more premium brands to improve the product mix, investing in sales and distribution, and controlling input costs to improve profitability. Recent initiatives include expanding the cheese business and a line of liquid protein supplements to target the sports market.

One area of concern has been Mengniu’s disappointing history of acquisitions, but we were encouraged to hear that there will be no further deals in the foreseeable future. Overall, we think Mr Lu has been candid and reflective about mistakes. He appears focused on building the team and brands rather than chasing growth, and we like his long-term vision.

Conclusion and outlook

Despite concerns around “down-trading” in the near term, we still believe that over the long run, Chinese people will become wealthier amid increasing urbanisation and GDP per capita. As this happens, they will likely want to improve their health and lifestyle, which favours consumer companies with effective premiumisation strategies like Midea, Anta Sports, CR Beer and Mengniu. We have owned these stocks for many years, and they have good track records over the longer term. To us, this reflects well on their management and franchise quality.

Through our regular research trips to China, we look beyond the country’s general economic weakness to find companies that are either bucking the negative trends, or are strengthening their market positions in the down-cycle. We think there are still plenty of quality companies, with strong brands and proven franchises that can achieve decent earnings growth over the long run.

We continue to seek the companies that will become the long-term winners, which are typically the industry leaders of today. And the lower valuation multiples reflect reduced expectations, which makes the potential risk-reward more attractive. As always, we would like to thank you for your continued support.

1 https://www.azquotes.com/quote/298590

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 14 February 2024 or otherwise noted.

Read our latest insights

- Article

- 8 mins

- Article

- 5 mins

- Article

- 5 mins

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.