China: Looking past near-term volatility

Fund Manager Q&A - June 2022

In the past two years, investors in China have faced challenges from policy reforms, Covid-19, and commodity price inflation. In a recent webcast for our clients, FSSA portfolio managers Winston Ke and Rizi Mohanty shared their insights on investing in the China market, as well as ASEAN as a fast-growing complement in a regional portfolio.

Investors have been concerned about China for a while. Do we still need to be worried, or are we seeing light at the end of the tunnel?

Sentiment has been weak recently, but as bottom-up investors we see volatility as an opportunity to add to high-quality companies and enhance our long-term investment returns. We are more focused on company fundamentals than market movements — as long-term shareholders of some of these companies, we understand their businesses and the management teams, and we trust them to mitigate the risks during these difficult times and continue to deliver earnings growth over the next three to five years, our typical investment time horizon.

Our China strategies have long-term themes such as consumption upgrade, healthcare upgrade, urbanisation and automation. These themes are still intact with strong secular drivers. Therefore we remain confident in our portfolio holdings.

Can we talk about inflation in the context of China and how companies are coping with it?

China imports oil, grain and copper from the global market, and the prices of these raw materials have increased. This is adding cost pressures for many Chinese companies.

When we first invest in a company, we evaluate the franchise and management carefully. If the sector is highly consolidated and if the company has strong brands, we believe it can deal with inflation better and pass on cost pressures to customers. But this takes time.

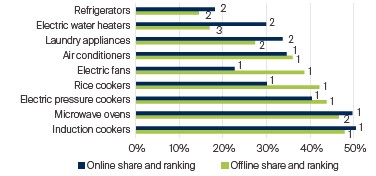

For example, the chairman of Midea mentioned to us that last year’s second quarter was the most difficult in their history, due to rising prices for copper, plastic and shipping. But their earnings growth stabilised in the following quarters because they are a leader in multiple segments, like refrigerators, air conditioning and washing machines. The market is highly consolidated and the company can eventually pass through cost increases to their customers.

Midea is the market leader and gaining share across various product categories (2021)

Source: FactSet, Midea Annual Report 2021, FSSA Investment Managers. As at 31 May 2022.

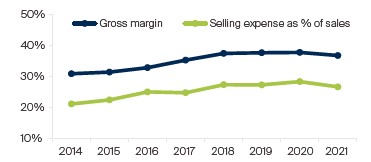

Another example is China Mengniu Dairy. This company experienced cost pressures around four years ago as the price of raw milk rose. But their gross margins increased in the last five years as they have been upgrading their product mix. They have been reinvesting their additional gross profits back into the brand and building channel management.

Mengniu’s margins have improved over time

Source: FactSet, Bloomberg and FSSA Investment Managers. As at 31 May 2022.

Investors are paying more attention to ESG, but there are concerns about greenwashing. Could you talk about your engagement experience with companies in China, and how that informs your view about quality and ESG of companies there?

Our team has always incorporated environmental, social and governance (ESG) factors into our investment process. We believe there is no such thing as a perfect company; what matters is the direction of travel. In China, the overall understanding of ESG is still at an early stage compared with developed markets, but people are paying more attention to it.

Our experience in engaging with China companies is quite mixed. Some just don’t respond, which speaks volumes about their attitude towards ESG. Of course, there have also been interactions which were encouraging.

In the case of Mengniu Dairy, we engaged with the company by writing a letter to the CEO to address a few concerns, like gender diversity of the board and carbon emissions from cows. The company responded actively to our concerns and made plans to improve. They have added one female non-executive director into their board, and promoted two women into the senior management team. The company also hired a third-party consultant to produce a comprehensive ESG report.

We believe by using a bottom-up approach for ESG, rather than just looking at third-party ratings, one can avoid the risk of greenwashing.

Can you talk about the interesting opportunities in the ASEAN market?

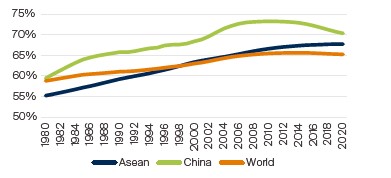

ASEAN has always been an integral part of our Asia ex-Japan strategies. There are a few things to like about this region. The first is demographics. It has the third-largest population of working age people, so as the rest of the world ages, this could be an opportunity for ASEAN in terms of manufacturing and services. This can lead to better consumption growth and other positive follow-ons.

Percentage of working age population (15-64 years old)

Source: OECD, World Bank, Google/Temasek/Bain & Company report. As of Feb 28, 2022.

The second big theme is digitisation, which we have seen in South Korea, China and the US for the last 10 years. We are at the starting point in ASEAN which has a very young online population. The penetration of e-commerce, food delivery, ride-hailing and other online activities is increasing.

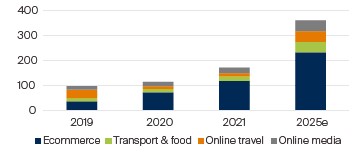

ASEAN has over 450m million digital users and growing internet economy (GMV, US$ billion)

Source: OECD, World Bank, Google/Temasek/Bain & Company report. As of Feb 28, 2022.

Lastly, ASEAN has been an unloved market for the last 10 years. But valuations are attractive now, and so is the risk-reward. Foreign ownership rates are as low as they’ve been in the last decade, which makes the region a good hunting ground for long-term investors.

One company we own is Jardine Cycle & Carriage. The company has been around for more than 120 years and has gone through many cycles. It is 75%-owned by the Jardine Group, which we consider to be a good parent in terms of governance and quality. The business is comprised of multiple leading franchises in ASEAN, such as Astra, the largest auto business in Indonesia. It also has one of the largest auto businesses in Vietnam via THACO, and a stake in Vinamilk, the largest dairy company in Vietnam.

Historically the Asian Equity Plus strategy tends to hold up well in a risk-off environment, but has been challenged recently. Can you share the reasons for the weakness in performance, and some of the key detractors?

The regional Asian Equity Plus strategy held up well last year, but has been disappointing in the first half of this year. The first reason is due to not owning companies in areas like energy and materials, which have outperformed on the back of commodity price inflation. Our process focuses first on quality, and it can be difficult to find suitable long-term investments in the energy and materials sector. The companies tend to be cyclical and lack pricing power, and we would rather stay true to our investment philosophy than chase short-term outperformance.

The second reason is the regional strategy’s exposure to Japan, which has detracted because of the sharp devaluation of the yen. We still like the companies from a 3-to-5 year horizon so we continue to add them. Finally there have been a few individual company that detracted from performance, such as LG Household and Health Care in Korea, a cosmetic company that has been challenged by lockdowns in China and the lack of travel.

Our response is to focus on the longer term and look past the short-term volatility. For example, we have held Techtronic for many years and it has done well over the past decade. Investors tend to take profits when they worry about the slowdown of the US economy, but the management are driven and want to gain further market share.

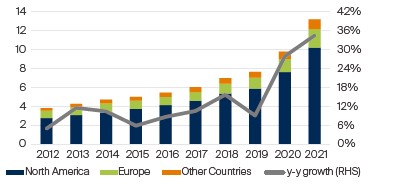

Techtronic’s sales (USD bn) have compounded over time, driven by North America

Source: Bloomberg, company reports, FSSA Investment Managers as of 31 May 2022.

While you have always had ESG embedded in your process, are you able to replicate this in China, for example with ownership?

In China, company owners are usually either state-owned enterprises (SOEs) or private companies. For SOEs it could be more challenging to have a solid ownership structure or governance structure. But recently we have seen some positive developments amid the SOE reforms.

With Mengniu, Danone was previously the second largest shareholder, which led to a balanced board. The central SOE, COFCO Group, was unable to dominate the decision-making. Meanwhile, the company has been listed in Hong Kong for over 15 years, and we could sense their intention to improve their governance.

This was a positive case, but there are other cases where the board is dominated by government officials who value their political careers more than shareholders. In such cases, we would avoid owning those companies. Since we are benchmark-agnostic, there is no company or stock that we need to own, and we only need to find a handful of good companies.

Can you share your outlook for China’s property sector?

Firstly, we believe stock selection is important when it comes to the China property sector. We own China Resources Land (CR Land) in the portfolio which has done well in the last 5-to-10 years, including during the sector volatility last year. CR Land is an SOE and has been listed in Hong Kong for many years. It has a diversified shopping mall portfolio in Tier-1 and Tier-2 cities, so the underlying growth driver is primarily about consumption upgrade rather than property prices. On the other hand, we did not invest in the private developers which leveraged up aggressively and eventually suffered from the government’s changing policy.

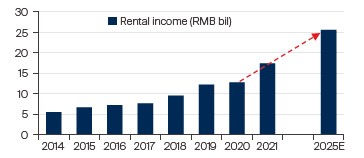

CR Land: Management aims to double rental income during 2020-2025

Source: Company reports, FSSA Investment Managers. As at 31 May 2022.

Secondly, the government has largely achieved the target of reducing leverage among property developers, and turned more supportive amid the broader economic slowdown.

In these leaner times, we expect the sector to consolidate, and leaders such as CR Land to gain market share. Meanwhile people are worried about the sector so valuations have become attractive in our view.

From an investor appetite perspective, have you seen a declining interest in exposure to China A-shares?

Interest in China A-shares can be impacted by short-term market performance, as with other equity markets. But there is also a strong secular growth trend for China A-shares — they are gaining inclusion into global equity indices. Right now they comprise around 15% of the MSCI China index at a 20% inclusion ratio, but if they were fully integrated, they would account for around 40%. They would also become a large part of the regional equity index. Therefore, we expect global institutional investors to have a strong interest in China A-shares over the long run. There are plenty of opportunities in this universe, but the key is to find the high-quality companies.

How do you view the Chinese government’s supportive stance on the economy? How are you and the team navigating the macro themes of U.S. sanctions and China’s zero-Covid strategy?

In general, we try to stay focused on company fundamentals. Macro issues can change quickly, such as the government switching from a hawkish to a more supportive stance in the past year. Recently they have also become more accommodating towards internet companies and delivery companies, because unemployment is rising and these companies can provide many jobs.

However, we do not expect massive stimulus like we saw after the 2008 financial crisis. We think the government wants to be more targeted this time, for example in supporting consumption, home-buying, and autos.

In terms of Covid, the second quarter saw some negative impact on economic growth and company earnings, and the market has reacted to these uncertainties. However, the situation in Shanghai has become more stable and many companies in the value chain, especially in the auto sector, have recovered. We think investors will look beyond the weak performance in the second quarter.

From an Asia Pacific portfolio perspective, any plans to increase the allocation to other countries instead of focusing on China?

Our portfolio construction for the region starts with bottom-up stock-picking, on a company-by-company basis, and our allocation to China is simply an outcome of the investment opportunities we have found there. We own less in China than many others and versus the benchmark. We tend to have exposure to India because of the quality of companies there. India has had 100-plus years of capital markets, with multi-generation businesses that value minority investors. The same applies to parts of Southeast Asia. So whether we change our allocation to a country depends on the bottom-up opportunities we see.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 31 May 2022 or otherwise noted.

Important Information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ or FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore.

First Sentier Investors and FSSA Investment Managers are business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) and FSSA Investment Managers (registration number 53314080C) are business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.