Green shoots appearing but challenges remain

July 2022

In this China update for mid-2022, we discuss some recent topics of interest as highlighted by our clients. Besides our usual portfolio updates, we share our views on the energy rally, electric vehicle (EV) companies, and environmental, social and governance (ESG) developments among the Chinese companies we own.

We are seeing more green shoots appearing in China as Covid restrictions are easing with the reopening of Shanghai and other cities. Manufacturers have ramped up production while delivery times were shortened, supporting a re-acceleration in China’s exports. As supply chain constraints are resolved, this should help to temper global inflation. Other supportive policy actions in recent months include easing restrictions on internet companies and plans to increase infrastructure spending. We expect this pro-growth stance to continue, albeit at a measured pace.

However, key challenges remain and any recovery could be fragile. The risks include further interest rate hikes from the US Federal Reserve leading to a stronger dollar, which is typically negative for emerging markets – it increases their USD funding costs, spurs capital outflows and limits the scope for interest rate decreases in China. Domestic headwinds are still in place, such as high levels of debt-to-GDP, weakness in the property sector and uncertainty around regulations. Another risk in our view is renewed lockdowns in China amid the “dynamic Covid-Zero policy”. While we cannot fully predict the short-term policy actions on the back of Covid cases, we think the government is shifting its priority toward boosting the economy, given the recent challenges and the reopening of the rest of the world.

In the longer term we are more sanguine on China, as we believe that the structural growth drivers are intact – including growing wealth and rising incomes driving a consumption-led economy; increasing demand for better quality, higher-priced goods and services; and growing sophistication in technology and domestic import substitution.

New positions in China

As bottom-up investors, our focus is on identifying high-quality companies with strong management teams and sustainable franchises; in other words, long-term earnings compounders.

New positions in our China strategies include Chacha Food, a dominant leader in sunflower seeds with a 20-year history, which has been expanding into the nuts business. We think this company is a beneficiary of the premiumisation trend – expanding into higher-priced goods to improve profitability. Chacha’s key competitive advantage is its offline distribution channel, which has helped the nuts business gain traction since it was launched in 2016.

Prior to this, sales had been stagnating for a few years, after the chairman/founder stepped down. After his return in 2015, he managed a successful turnaround by restructuring the organisation, spinning off the loss-making businesses (jellies and condiments) to refocus on sunflower seeds and introduce higher-end flavoured products. The company’s execution track record has since improved, and along with it profitability. Meanwhile we expect the chairman to stay in his role for the next few years, while his daughter (who is on the board and senior management team) is a potential successor.

Figure 1: Key Chacha Food products (from left to right – the red packages are the signature sunflower seeds; the blue and green packages are the flavoured sunflower seeds; and in yellow are nuts for daily consumption and a nuts gifting package)

We also bought Weichai Power, an example of domestic companies’ growing sophistication in technology, on attractive valuations. Weichai is a China market leader in diesel engines for heavy-duty trucks (HDTs). While HDTs are primarily run on diesel engines, Weichai has invested in “new energy” areas such as fuel cell technologies and electric motors and controls. We believe this could provide additional areas for earnings growth .

Meanwhile, Weichai seeks to gain market share in its core engine business. The chairman comes across as confident and passionate about the business. He believes that the different types of engines will co-exist for the coming decades, which explains why Weichai intends to continue its research on diesel and liquefied natural gas (LNG) engines.

A third significant new position is Shanghai Hanbell, another domestic player with growing technology capabilities. Hanbell is a leading maker of screw compressors which are used in cooling and general industrial applications. In recent years, its main growth drivers have included energy efficiency improvements in air conditioners, cold chain development and the coal-to-electricity conversion. To give an idea of the market potential in cold chain logistics, China’s per capita cold storage capacity is around 40% of Japan’s level, and 25% of the US. We expect this to grow along with the trend of fresh food e-commerce in China.

Meanwhile the company’s emerging business of screw vacuum pumps should enable growth into new areas such as solar, semiconductors and electric vehicle (EV) batteries. We like the management’s strategy of step-by-step expansion, with a focus on operating cash flows and employee welfare/retention. Our research suggests that Hanbell’s vacuum pumps are viewed as the best among domestic suppliers in terms of cost efficiency and reliability. For cooling compressors Hanbell already has 40 to 50% market share and sets the standard in the industry.

Maintaining conviction in major holdings despite short-term headwinds

Year-to-date, key contributors in our China strategies included Shanghai International Airport (SIA), China CYTS Tours, and Tsingtao Brewery. Although fundamentals had yet to improve in the second quarter, these companies benefited from the optimism surrounding city reopenings. They had also taken steps to optimise their operations such as improving cost controls, which should make them better positioned once sales rebound.

We believe domestic travel still has room for growth, given China’s expanding middle class. For example, SIA operates a natural monopoly in one of China’s busiest travel hubs and should benefit from continued growth in passenger volumes. Covid has pushed back the immediate need to expand but in the longer term, SIA plans to add a third terminal and fifth runway. The company’s track record shows it has been well run despite government ownership.

We also saw strength in real estate and related companies such as China Resources Land (CR Land), Zhejiang Weixing New Building Materials and China Vanke, as government policies turned more supportive from last year’s crackdown on overleveraged developers.

We believe CR Land, a top 10 developer and major mall operator in China, is well positioned to benefit from industry consolidation given its healthy balance sheet and strong portfolio of investments. One of CR Land’s key strengths is its ability to acquire land through projects, which can be higher margin compared to land-bidding auctions. Its deep-rooted connections in Shenzhen and reputation in investment property operations are major advantages when competing for projects.

Zhejiang Weixing is a leading manufacturer of drain pipes used in residential buildings, city water and gas supplies. The company has delivered a strong track record of growth, driven by the refurbishment market. More recently, the company has managed to raise selling prices, thus easing margin pressure from higher raw material costs. The management seems prudent about business development, which aligns with our focus on investing in companies with quality and sustainable growth.

On the other hand, some of the biggest detractors in our China portfolios year-to-date included Midea Group, SF Holding and China Merchants Bank, but we continue to hold conviction in them.

With the recent price inflation in supply chains, investors have been concerned about rising cost pressures for Midea Group. Meanwhile, industry data showed weak retail demand for household appliances such as air conditioners, refrigerators and washing machines, due to the lockdowns in major Chinese cities.

However, we maintain our conviction in the company’s long-term prospects, as fundamentals have been resilient in the challenging operating environment and we think the market has not fully appreciated this. Valuations are attractive, with a 9% free cash flow yield and share buybacks from the company. Midea has been generating growth in revenue, profit and operating cash flow on the back of its strong franchise and efficient management. To further improve the quality of growth, Midea has adjusted its strategy by prioritising profitability and returns. At the same time, the company plans to develop new businesses such as heating, ventilation & air conditioning (HVAC), automation and auto components.

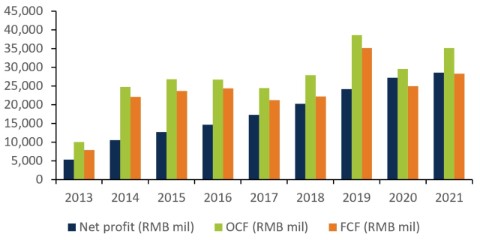

Midea has a long track record of robust cash flow generation

Source: FactSet, FSSA Investment Managers. As at 30 June 2022. OCF = operating cash flow; FCF – free cash flow

SF Holding, an express delivery company, suffered from lower earnings in 2021 due to the mismatch of internal capacity management. The management team has learned its lesson and has now optimised capacity by reining in the loss-making business segments. Growth has started to recover since 2H 2021, along with pricing on the back of tighter regulations around unfair price competition. The company also gained market share due to increasing demand for its high-quality services. Lockdowns in China hurt the volumes of shipments during the first quarter, but shares have been recovering from April together with general signs of reopening.

The company recently announced employee stock option plans (ESOPs) with performance targets in revenue growth and margin improvement through 2025. We believe the time-definite parcel business can generate decent profits and strong cash flows to protect the downside risk, while newly-developed businesses such as cold chain, trucking and supply chain management can drive growth in the longer run.

China Merchants Bank (CMB) announced in April that its President Mr Tian Huiyu had stepped down. It was a negative surprise for the market, compounded by the follow-up news that Mr Tian was being investigated for suspected breach of party discipline. We believe the negative reaction was overdone. China Merchants Bank has a strong culture and franchise which can mitigate the risks inherent to management changes. The bank also has a strong senior management team which has been with the bank for many years.

In the following month, the bank nominated Mr Wang Liang as the successor, which seemed to calm the market. The 27-year veteran was previously head of the Beijing branch among other roles. We believe this is a positive development, based on how he has exhibited the bank’s values and strategy thus far.

CMB has a long-term track record of prudent risk management (such as minimal exposure to property developers last year) and organic growth in assets without needing to raise capital in the market. The shares are at attractive valuations, with a price-to-book ratio at 1.1x and 17% return on equity (ROE), based on 2021 figures.

Within our China portfolios we also have holdings in the pharmaceutical, medical equipment and industrial automation sectors. These holdings are attractive for fundamental reasons — and less reliant on government policies, property measures, interest rates or GDP growth. If we believe such companies have the potential for future growth, we are less concerned about short-term market noise.

Treading carefully in energy and electric vehicles (EVs)

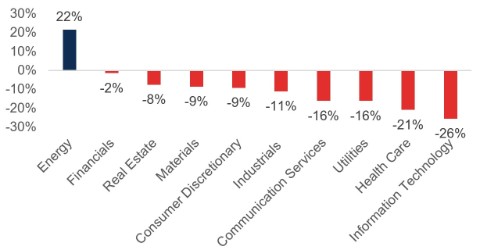

Among the MSCI China sectors, only energy had a positive return year-to-date as the Russia-Ukraine conflict escalated. As we don’t own companies with direct exposure to coal or oil production, this has affected our relative performance; but we are happy to sit out the rally and stay true to our investment philosophy rather than chase short-term outperformance.

Year-to-date returns through end-June, MSCI China

Source: FactSet, USD returns as of 30 June, 2022.

We see many reasons for not owning such companies. Our process focuses first on quality, and it can be difficult to find suitable long-term investments in the energy sector. Commodities-driven companies tend to be cyclical and lack pricing power. We are also concerned about their demand potential in the long run given environmental concerns.

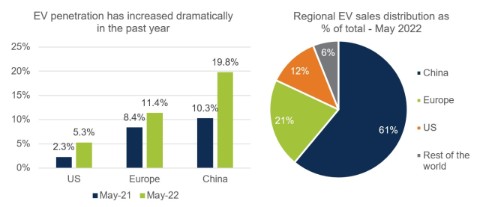

Another group we are less enthused about is electric vehicles. China accounts for 61% of the global electric vehicle (EV) market. Penetration has nearly doubled in the past year while the US and Europe markets are also growing quickly. But as long-term investors, we have yet to see evidence that these companies are able to deliver on their promises – and whether they have the ability to build a strong economic moat.

Source: EV-volumes.com, Morgan Stanley, as at May 2022. Figures refer to pure battery electric vehicles, excludes plug-in hybrids.

After some consideration we think valuations appear stretched, indicating high expectations on both profitability and volume. The sector is evolving quickly with competition increasing while visibility remains low. We are seeing a proliferation of models being built and rolled out, along with aggressive capacity expansions. Given the fast evolution among carmaker and battery companies, it is difficult to predict the long-term winners and we have minimal exposure for now.

We do hold some industrial companies in our China portfolios with growing EV-related businesses. To highlight a few examples, we own Hongfa Technology, Shenzhen Inovance and Nari Technology, which have growing exposure to the EV value chain along with dominant franchises in their core products.

Hongfa Technology is the world’s biggest relay maker with 17% market share, having overtaken Omron, Tyco and Panasonic to assume global leadership. A relay is an electrical switch which converts small electrical stimuli into larger currents. This function is critical for a wide range of standard appliances and vehicles, making relays indispensable in all kinds of electronic equipment. In vehicles, they can power gas valves, headlights, windshield wipers, interior lighting and alarm systems.

New applications such as high-voltage, direct current (HVDC) relays are growing rapidly due to EV and renewables growth. Hongfa has around 36% of global market share in EVs. It supplies to all major original equipment manufacturers (OEMs) including Tesla, Volkswagen and Chinese EV start-ups. Meanwhile shareholder alignment is strong, with senior management collectively owning 34% of the company.

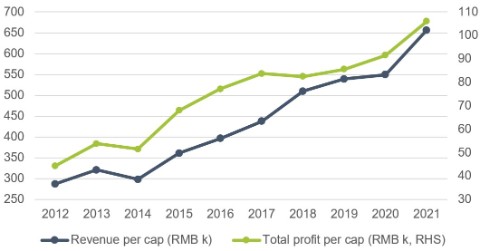

Hongfa: Consistently improving productivity

Source: Company filings, FSSA Investment Managers as of 30 June 2022.

Shenzhen Inovance is an industrial automation company with leading positions in inverters (which change direct-current power from a battery into conventional alternating-current power for operating devices), servo motors (which rotate machine parts with high precision) and new energy vehicle controllers (which coordinate the driver’s inputs into the vehicle’s subsystems, such as making the brakes smoother in a sudden stop). The company’s ownership and alignment are strong, with a dedicated team of founders who have grown Inovance from a small inverter maker into China’s most successful automation company over the past 20 years.

Nari Technology is a leading power grid automation company with world-class technology and limited competition due to its close relationship with the State Grid. We think Nari will be a major beneficiary of the power grid reform and integration of renewable energies, with its expertise in grid automation, EV charging and HVDC transmission.

Given the rich valuations and recent run-ups, we have trimmed our positions but these three companies remain high-conviction holdings for the long term.

In contrast, we do not own BYD, an integrated EV producer, which has gained market share because its highly integrated supply chain helped to source key components amid recent shortages. We have been following the company for some time, but it barely makes any profit and we are unsure if it can defend its market share after EV supply chains return to normal. We believe its high valuations may be unjustified and although the stock has performed well this year, we have not bought the shares.

When the market is fixated on a particular theme – what we call a thematic market – we believe it is best to be cautious and avoid the herd mentality. Sometimes that means missing out on the stocks that have performed well, but are yet to prove themselves as long-term earnings compounders.

Engaging with Chinese companies on ESG

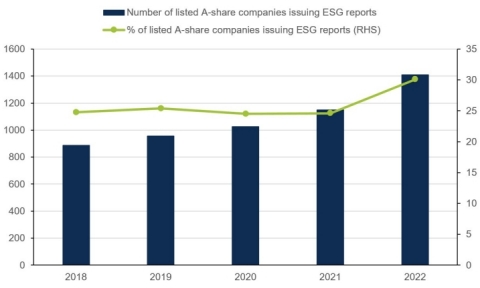

Although Chinese companies are newer to ESG than those in the West, progress has accelerated alongside the country’s major policy initiatives, such as the goal to achieve carbon neutrality by 2060 and the structural opening up of China’s onshore capital markets. The number of A-share companies issuing ESG reports has risen significantly this year. Companies are also conducting more buybacks and employee share option plans (ESOPs), showing better alignment with minority shareholders.

Rising number of listed A-share companies issuing ESG reports

Source: CLSA. As at 30 June 2022.

As bottom-up investors, we hold regular meetings with the senior management of our portfolio companies, with ESG often being a key topic of discussion. We typically conduct more than 1,500 company meetings per year, and 2022 is no different. As of end-June we have held around 800 meetings with management, including 200 at Chinese companies.

ESG is not only becoming a more frequent topic of discussion; we are also holding more meetings exclusively dedicated to ESG and related matters. We like to see a company’s leadership team being actively involved in its ESG committees, and we monitor progress over the long term towards stated targets. We prefer to take a partnership approach with our investee companies, gradually nudging towards specific outcomes rather than being dogmatic or prescriptive.

A few of the recent ESG-focused meetings we held were with AIA Group, Anta Sports and CK Hutchinson. For all of them, it was our first time meeting their newly-established ESG teams. We highlight some key takeaways from these meetings below.

When we met with AIA Group, Asia’s largest regional life insurance group, we were impressed by their internal organisational structure and the level of engagement on ESG from senior management. The company is highly transparent in its disclosures with clear quantitative metrics and a distinct focus in its ESG priorities. For example, they are fully disposing of coal-related assets in their funds and adding exposure to green bonds and renewable energy. There is also a drive for better record-keeping and digitisation for tracking progress with their investee companies. We plan to monitor and revisit these developments over time.

Anta Sports frequently comes up in our team discussions on ESG given its exposure to Xinjiang cotton sourcing concerns and allegations of forced labour in its supply chain. We met with the CFO and the chairman of the Sustainability Committee to better understand its ESG efforts. Importantly, the company has formulated a detailed strategy to increase transparency over its supply chain including simplifying its list of suppliers and a project to map traceability. Anta is also working to align towards internationally recognised sourcing standards. We expect ongoing challenges given how fragmented its cotton sourcing is, with hundreds of indirect raw material suppliers.

Anta is still young but has high ambitions for ESG, with targets embedded into key performance indicators (KPIs) for key members of the leadership team down to department heads. It is the only Chinese sportswear company so far to pledge carbon neutrality by 2050, committing to a full range of sustainability targets including recyclable materials and biodiversity. While human rights risks remain, we feel comfortable with the company’s efforts to improve and will continue to engage on this concern.

CK Hutchison is a Hong Kong-listed conglomerate with four primary business lines – telecommunications, retail, infrastructure and ports. The company is still in the early stages of tackling ESG matters and has made climate change and emissions as its top priority with aims to reduce its greenhouse gas intensity. Its infrastructure division is the group’s highest scope 1 and 2 emitter, accounting for 85% of the group’s greenhouse emissions. This includes coal-fired plants under its electric utility subsidiary Power Assets. In our meeting, we also mentioned the board composition (board size and directors’ ages), alignment at CK Asset and the lack of serious capital returns as areas to improve.

Some other noteworthy engagement discussions include Yum China and JD.com.

We held a meeting with the CFO of JD.com and requested a further update on the company’s ESG efforts. The CFO mentioned that there is strong buy-in from the board; and that the areas of focus include green infrastructure (warehouses and vehicles) and the treatment of blue collar workers (in which it is doing more than peers, with delivery staff all directly employed and paid social benefits). Disappointingly, it seems little progress has been made around the integration of ESG into KPIs for senior management. We will follow up on this, and on the tendency to employ staff in separate listed entities such as Dada.

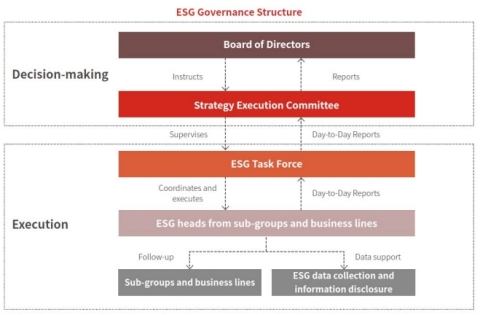

The ESG governance structure of JD.com shows high involvement from the board

Source: JD.com’s 2021 Environmental Social and Governance Report.

We met with the CEO of Yum China, in large part to discuss the sustainability of its predominantly part-time staffing model. To give some context, Chinese companies with a large employee headcount must balance social considerations with business ones, given the political importance of widespread employment. The CEO was pragmatic on the subject, saying that the company will always have part-time workers, but recognised that they will likely have to hire more full-time workers as the country’s demographics mature. Given Yum China’s rising costs in recent years, we will continue to engage on the topic.

Conclusion

These examples have been selected to show the diversity of topics we discuss with our portfolio companies and to highlight our approach towards ESG engagements in China. For companies in the early stages of improving their ESG practices, such as CK Hutchison and JD.com, we are monitoring the execution closely, while AIA Group and Yum China are more advanced in their ESG thinking, with more disclosures and data readily available.

When it comes to sustainability, we believe Chinese companies are shifting their mind-set from an environment of “growing from zero/a low base” to “don’t get left behind”. Perhaps the sense of urgency increased after President Xi Jinping announced the China’s carbon neutrality goals in late 2020. We are encouraged by the steps taken and look forward to more green shoots in this space.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 30 June 2022 or otherwise noted.

Important information

The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material.

This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of FSSA Investment Managers’ portfolios at a certain point in time, and the holdings may change over time.

In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore.

First Sentier Investors and FSSA Investment Managers are business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B) and FSSA Investment Managers (registration number 53314080C) are business divisions of First Sentier Investors (Singapore).

First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions.

MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.