This is a financial promotion for The FSSA Global Emerging Markets Strategy. This information is for professional clients only in the UK and EEA and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

- Emerging market risk: Emerging markets tend to be more sensitive to economic and political conditions than developed markets. Other factors include greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities.

For details of the firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

FSSA GEM Focus strategy reaches 5-year anniversary

Quarterly Manager Views - December 2022

Investment management is an industry where in the short run there is usually little relationship between process and outcome. In the long run, however, the link is very strong. Five years ago we launched the FSSA Global Emerging Markets Focus strategy. It has been an interesting time to invest in emerging markets — we have witnessed the tragic war unfold in Ukraine, increased geopolitical tensions between the US and China, panic over the election of leftist governments in Latin America, nationwide lockdowns in response to Covid-19 and a brief period during 2020/2021 where we began to question the sanity of markets (refer to our note on Growth Traps). Over this period, we have stuck to our long-established investment process, which emphasises bottom-up, benchmark-agnostic portfolio construction, with particular focus on the quality of management, the quality of franchise and, last but not least, valuation discipline.

We tend not to comment on performance in these letters, but as five years have now passed we think it an appropriate point to pause and take stock of the journey so far. A patient investor in our fund would have received an annualised return of 5.9%1 (in EUR, net of fees) compounded over these five years. This is a touch disappointing and below what we expected when we set out five years ago. To be sure, it is more than the return from the benchmark index (MSCI Emerging Markets) which has returned 2.2% annualised through the same period. However, whilst we struggle to be satisfied by the absolute returns, we are encouraged by the underlying operational performance of our key holdings during this tough period. Indeed, in our opinion the strategy is very well positioned in terms of the potential of the underlying companies.

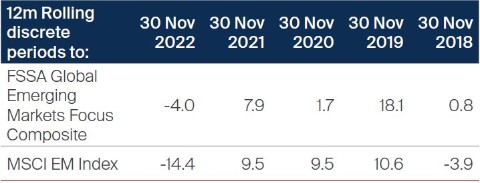

Composite Performance (EUR) to 30 November 2022

These figures refer to the past. Past performance is not a reliable indicator of future results. For investors based in countries with currencies other than USD, the return may increase or decrease as a result of currency fluctuations.

The strategy performance figures is the weighted average performance of FSSA IM’s funds that contribute to the strategy in question, is based on monthly performances and are net of a default annual management fee of 0.85%. Source: MSCI / First Sentier Investors. Since inception performance figures have been calculated from 30 November 2017 – 30 November 2022.

We are constantly trying to learn and improve our investment process. Naturally then, we felt it pertinent to reflect on the past five years and share our learnings.

“Time in” the market is more important than “timing” the market

This old adage, often quoted by Warren Buffet, has certainly been true for our strategy. It is rare to identify companies that have both a quality management team and a franchise that compounds free cash flows (or book value per share) at attractive rates for long periods of time. Where we have managed to find such companies, we believe the most important thing is to hold on and do nothing. Of the Top 10 contributors to fund performance over the past five years, six are companies we have owned throughout the period and three have been in the portfolio for around three years. MercadoLibre is a case in point — we have owned the company since inception of the strategy. As Latin America’s leading e-commerce company, sales have grown nearly eight-fold over the past five years. However, given the fact that poorly-run e-commerce businesses can destroy value at breathtaking scale, we are firmly focused on the cash flows. In this regard too, the results have been impressive: free cash flow (FCF) has grown five-fold, from USD200m in 2017 to an estimated USD1bn in 2022. This has driven the 28% CAGR2 total shareholder return over this period. In 2021, when we noticed that valuations had swung to an extreme (10x Enterprise Value-to-Sales!), we decided to take some profit off the table, which proved to be prudent as the share price then fell 70% from the peak. We have since bought back at lower prices and reinstated our previous position size.

Owning a quality company through a period of turbulence is a test of patience and conviction. For example, HDFC Bank, which has been a team favourite for nearly 20 years, has been undergoing a period of readjustment following the retirement of its founder CEO, Aditya Puri, after a successful 26-year stint. Over the past five years, the bank has compounded book value per share (BVPS) at its usual (stellar) pace of 20% CAGR, but valuations have de-rated owing to some short-term concerns. As a result, total shareholder return has been just 12% CAGR, which, whilst good enough on an absolute basis, should improve over the coming five years. Capitec, one of the leading banks in South Africa, is another example of a compounding machine. Despite the macroeconomic challenges in the country (more on that topic later), the bank has delivered 12% CAGR total shareholder returns over the past five years in USD terms. This has been driven by the highly profitable lending operation combined with a low-cost deposit base (the bank consistently earns an astonishing 5% return on assets). As a result, BVPS has grown at 17.5% CAGR over five years, underpinning shareholder returns.

For good quality companies, time becomes your friend. We will endeavour to find these kind of companies and hold them as long as possible.

Overwhelmed by macro

Our team has a long track record of investing in what many would deem to be difficult markets. In general, we have focused on finding companies that are able to withstand (perhaps even thrive) in volatile macroeconomic environments. However, in some rare instances, external macroeconomic issues can completely swamp even the best-run company. In this regard, it is worth recounting our investment in the Argentine bank Grupo Financiero Galicia. During 2017, our meetings with the CEO and several other members of the senior management team pointed to a culture that we liked and a franchise that was inherently strong — the bank had averaged 37% return on equity (ROE) for the previous 5-year period. More importantly, its performance was underpinned by a good deposits franchise (11% of all private deposits in the country). With the country electing a new leader, President Mauricio Macri, it seemed as if Argentina would regain its former glory and the issue of hyperinflation would finally be controlled. However, shortly after we made our investment, politics in the country took a dramatic U-turn (left turn?) and the economy, which had been improving, was destabilised yet again. Despite the bank performing well operationally, the intense currency headwind meant that we subsequently sold out of our position at a loss. This has been our single largest detractor since inception, costing us close to 250 bps of performance.

Another example of a mistake where we underestimated the macroeconomic headwinds was the case of AVI Limited, a leading consumer staples company in South Africa. In this instance, we were mainly attracted by the returns-focused CEO and his approach to capital allocation. The company had generated 25% returns on capital employed (ROCE) for the 10-year period prior to our investment and managed to deliver 25% during the 2017-22 period as well. However, the company was unable to grow faster than the currency was depreciating, leading to flat revenues and profit for over five years. It turned out to be what we refer to as a “weak compounder”. This lack of growth meant that valuations were steadily de-rated and we eventually sold our position to fund better ideas elsewhere.

These have been expensive lessons, with the outcome being that we now systematically check and limit our portfolio exposure to so-called “high-risk” economies (simplistically defined as those with adverse macroeconomic conditions).

Stay disciplined

One area that is perhaps overlooked when it comes to investment performance are the mistakes that were avoided. During late 2020 and through 2021, we witnessed a global market mania that perhaps hadn’t been seen for decades. There was a frenzy of initial public offerings (IPOs), most of which had dubious business models and sketchy financials. Meanwhile, valuations lost all relation with fundamentals as companies that were beneficiaries of Covid-induced work-from-home strictures were bid up to stratospheric levels. Most of the “stars” of this time were businesses that we call “Growth Traps”. They are characterised by a business model wherein a constant supply of capital is needed to fund operating losses, as the profit pool of an established industry (such as advertising or retail) is transferred to customers. There is no evidence yet of such companies being able to capture the profit pool they have destroyed in their quest for scale.

In these phases, it is important to stay disciplined and not be enticed into overpaying for stocks. Our team helps us stay grounded and avoid mistakes in times like these. We have not participated in any IPOs for the GEM strategy over the past few years, most of which are now languishing below the listing price. Nor have we bought into flawed business models that promise a “path to profitability”.

Conviction comes from thinking long term

The Covid-19 pandemic has dominated most aspects of life and business for nearly three years now, with places like China still battling the spread of the virus. Several of our holdings were also significantly challenged during the pandemic as the unprecedented lockdowns took its toll on their businesses.

For instance, the Mexican Starbucks operator, Alsea, had never experienced same-store sales declines of more than 4% prior to the pandemic, but during the second quarter of 2020, sales declined by 60-70%! For some of our travel-related companies, like Mexican airport operator Grupo ASUR, or the leading Online Travel Agent (OTA) in Latin America Despegar, the year-on-year sales decline was even greater, at 95%. The financial services companies we owned, such as Indian private-sector banks HDFC Bank or ICICI Bank, were also dealing with unprecedented circumstances whereby they didn’t know if a majority of their borrowers would be able to make interest payments, given the national lockdown imposed in India during April-May 2020.

At this point, we took a step back and conducted a deepdive review of our holdings. We had calls with management teams and re-evaluated their businesses. Fortunately, this gave us greater conviction in the longer-term trajectory of our holdings. The majority of them are market leaders in their respective industries and we realised that if they were struggling, their competitors would be even worse off. From our conversations, it became increasingly clear that when the lockdowns eventually ended, our holdings should have even higher market share and face less competition. Not only that, but because they were cutting costs (by renegotiating rental agreements and supplier contracts, and focusing on efficiency), operational leverage should result in an expansion of margins, which in many cases would outstrip their pre-pandemic highs. As such, even though the early stages of the pandemic were particularly challenging, we tried to look beyond the immediate situation — and we found some very attractive bargains, especially among Indian private-sector banks and Latin American restaurant and travel companies.

Overall, this period of volatility has kept us on our feet and truly tested our conviction in the long-term potential of the businesses we owned. We are now quietly hopeful that the next period will be quite rewarding for the strategy.

Stick to the process

As we look forward, we couldn’t be more pleased with our team and the investment process that we have in place. Our emphasis remains on aiming to preserve capital and growing it sustainably, simple though it sounds. Over the more-than-30 years since the establishment of the FSSA team, the investment process has been honed continually, taking these and other painful lessons along the way to evolve the process accordingly. While the next five years are unlikely to look like the previous five, we will continue to work hard on delivering satisfactory returns to our clients.

Over the past five years, the strategy has been consistent in terms of the number of holdings and concentration of the portfolio. The quality of the franchises we own has also been steady, reflected in the ROCE they generate. As we come out of the pandemic and economies recover, especially in places like China and India, we expect increased prospects for growth. This shows up in the consensus estimates for the earnings of our set of holdings.

Source: FSSA Investment Managers, Bloomberg. *Return on equity (ROE) for GICS Financial companies, and Pre-tax ROCE (i.e. earnings before interest and taxation (EBIT)/Capital Employed) for other portfolio companies. ** Based on Bloomberg consensus estimates.

Overall, this makes us very optimistic about the future of the FSSA GEM Focus strategy and that the best is still yet to come!

In this letter, we have tried to cover points which we think might be of interest to the strategy’s investors. If there are any questions or feedback concerning the strategy, our approach or operations, we would welcome hearing from you.

Thank you for your support.

1 For the FSSA Global emerging Markets Composite EUR, as at 30 November 2022

2 Compound annual growth rate

Related insights

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 30 November 2022 or otherwise noted.

Important Information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure. Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk. We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication but the information contained in the material may be subject to change thereafter without notice. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material . To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Investors.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:[1]

• European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

• United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

[1] If the materials will be made available in other locations, seek advice from Regulatory Compliance.