This is a financial promotion for The First Sentier China Strategy. This information is for professional clients only in the UK and EEA and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

- Single country / specific region risk: investing in a single country or specific region may be riskier than investing in a number of different countries or regions. Investing in a larger number of countries or regions helps spread risk.

- China market Risk: although China has seen rapid economic and structural development, investing there may still involve increased risks of political and governmental intervention, potentially limitations on the allocation of the Fund's capital, and legal, regulatory, economic and other risks including greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities..

- Concentration risk: the Fund invests in a relatively small number of companies which may be riskier than a fund that invests in a large number of companies.

- Smaller companies risk: Investments in smaller companies may be riskier and more difficult to buy and sell than investments in larger companies.

For details of the firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

How will the “common prosperity” drive and Covid-zero policy impact China’s long-term appeal?

Fund Manager Q&A - March 2022

Despite China being the first country to face the challenges of Covid, early optimism around its control over the virus seems to have waned. As Chinese cities and provinces continue to battle against new variants and local surges, consumer spending is down and the economy is starting to slow. On top of that, there have been increasingly cumbersome regulations on Chinese technology companies, the medical sector and the property market — the latter causing the implosion of a number of property developers late last year.

The Chinese government has now shifted to a more accommodating stance in a bid to stabilise the economy. But its “Common Prosperity” goal and zero-Covid policy is likely here to stay. Against this backdrop, FSSA’s portfolio managers discuss their views on the changing opportunity set in China — and how they have positioned the team’s China portfolios to tap into the longer-term growth story.

Do you think the recent headwinds in the China equity market have been priced in?

Martin Lau (ML): Having looked at China equities for more than 20 years, I try to focus on company fundamentals, rather than the macro environment or government policies. Since the inception of FSSA Investment Managers, we have been focused on seeking high-quality companies to invest in for the long term, believing that they will become stronger after each challenge or economic crisis.

When clients ask about the macro and whether it will be a V-shape, L-shape or U-shape recovery, or if there will be a hard or soft landing, the honest answer is that we don’t know — none of us can predict the future. We are equally as surprised when certain government policies are announced.

Ultimately, in our view it is company earnings that drive share prices. We believe a better question to ask is, “What will happen to Hong Kong and China company earnings in the next five to ten years?” If earnings are going to be higher, then the share price is likely to follow.

We can see that from the chart below.

Stocks tend to follow earnings in the long run

Hang Seng Index Price vs. 12-month Earnings Per Share (EPS) Forecasts

Source: Factset, FSSA Investment Managers, February 2022.

One of the top holdings in our China equity strategies is China Merchants Bank. For a number of years after it listed in Hong Kong in 2006, the share price went nowhere. First there was the Global Financial Crisis (GFC) and then investors worried about the true level of non-performing loans (NPLs) it had. More recently, the property slowdown has affected market sentiment and weighed on the share price.

But we have always liked this company. Even though it is a state-owned enterprise (SOE), China Merchants Bank has performed better than most other Chinese banks over the long term. Over the last 15 years, despite the uncertainties and cyclical concerns, China Merchants Bank’s earnings have risen steadily, as shown in the chart below. Holding this stock has generated decent returns for our client portfolios over the long run.

Stocks tend to follow earnings in the long run

China Merchants Bank (3968.HK) share price vs. forward EPS

Source: Factset, FSSA Investment Managers, February 2022.

That is not to say that we think property cycles and economic cycles are unimportant. It is just that we believe the quality of a company’s management and franchise, and whether earnings will be higher in the next five or ten years’ time, are much more important considerations.

With all that has happened, do you think China still offers attractive growth opportunities?

ML: In relation to China, we have always believed that the best time to invest is not necessarily when everything is positive. In our view the best time to buy is usually when everything is depressed.

The second point is on China’s policy response. The government has been trying to control the property market for more than four years now, so it is ahead of the curve in terms of policy tightening. When the whole world was trying to pump-prime the economy, China was tightening lending. This is perhaps the main differentiation between China and the rest of the world, as their out-of-sync monetary and fiscal policy could provide some support to the market.

Thirdly, we focus on fundamental research and analysis and we manage high-conviction portfolios. What this means is that when the market falls, we typically do not turn over our portfolios or sell out of our existing holdings. There is a strong belief on our team that every crisis presents an opportunity. During weak markets, better-quality companies often have an opportunity to gain market share and become stronger — and we can buy them at more reasonable prices than before.

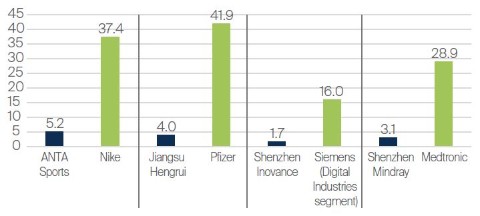

Looking beyond Covid and the recent economic uncertainties, we are still positive about the long-term growth opportunities in China. The chart below compares the revenue of a few of our holdings with their global peers to show what could happen in the future. For example, Nike is a global company and viewed as being the best sportswear company in the world. In China, we believe ANTA Sports is the best sportswear company domestically. Nike’s revenue is much bigger than ANTA, which implies that there is plenty of room for ANTA to grow.

Likewise, we believe that the best pharmaceutical company in China is Jiangsu Hengrui; the best automation company in China is Shenzhen Inovance; and the best medical equipment company in China is Shenzhen Mindray. There are fundamental reasons why we like these companies and it has nothing to do with government policies, property measures, interest rates, the state of the economy, or GDP growth. The key question is whether we believe these companies could become much bigger in the future – and comparing them against global peers gives us an idea of the growth runway.

Global winners

Revenue Comparison (2020, USD billions)

Source: Bloomberg, FSSA Investment Managers, February 2022.

Consumption in mainland China appears to be below expectations. What are your observations from being on-the-ground in China?

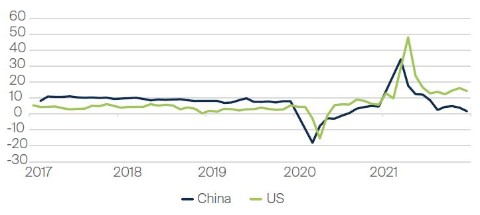

Helen Chen (HC): As the government stands firm on its zero-Covid policy, it has had a huge impact on people working in the services sector and the travelrelated industry. Income levels have flattened and high unemployment in the system means that consumer confidence, or consumption power, has been suppressed. The chart below shows how weak retail sales have been in China, especially in the second half of last year. It is fair to conclude that the post-Covid recovery is below expectations and investors are quite bearish.

China’s consumer demand lagged the US since the first Covid wave

Retail Sales Growth, Year-on-Year %

Source: Factset, FSSA Investment Managers, February 2022.

Despite the external challenges, we think that demand should be resilient for the companies that we own. The government has also introduced new stimulus measures to boost the economy (though it is still early days), which could provide some upside to demand.

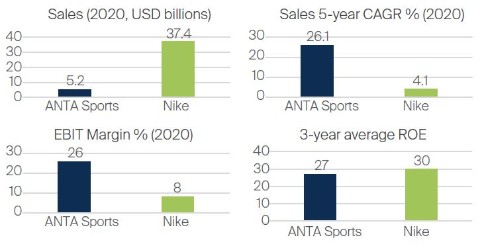

For example, ANTA Sports (mentioned earlier) is a leading sportswear company in China. Its more established brands are still growing healthily, contributing to its 5-year compound annual sales growth of 26%. The company has some new and emerging brands, which caught people's attention during the recent Winter Olympics in Beijing. As winter sports are still in the early stages in China, we believe there is potential for these brands to enjoy strong structural growth ahead.

Global winners

Anta Sports vs. Nike (Consumer sportswear/apparel)

CAGR = Compound Annual Growth Rate

EBIT = Earnings Before Interest and Taxes

ROE = Return On Equity

Source: Bloomberg, FSSA Investment Managers, February 2022.

What are your views on the property sector and property-related companies?

Winston Ke (WK): With Evergrande’s default late last year, there were many concerns about contagion risks. However, when we looked into the overall property sector, we believed that the systemic risk should be manageable. Evergrande had a large inventory of property, so after the government appointed SOE property developers to take over, they could develop and sell these projects to repay debts.

Also, as property is considered the backbone of the Chinese economy, we believe the government’s intention is not about destroying the sector. The “three red lines” policy was meant to rein in debt levels and prevent overly-stretched property developers from continuing to expand. As that target has now been achieved, the government has started to turn more accommodative on the property sector.

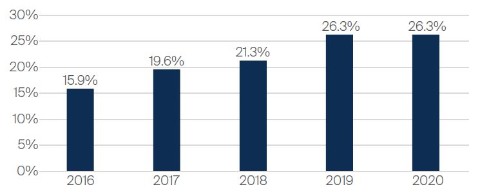

Nonetheless, in the medium term we expect the property sector to consolidate, which should benefit larger property developers with strong balance sheets. At present, the Top 10 real estate companies in China account for around 26% of the market. We expect that ratio to reach 30% within the next few years.

China’s property sector is still consolidating

Top 10 real estate companies, market share based on total revenue

Source: Statista, FSSA Investment Managers, February 2022.

Due to concerns about the overall sector, valuations have come down across the board. Broadly, we have found it difficult to invest in property developers due to their generally-stretched balance sheets, but there are a number of companies along the property value chain that we like. For example, we own Zhejiang Weixing New Building Materials, which provides household pipes, underfloor heating, water purifiers and waterproofing materials.

Although related to the property sector, the key underlying growth driver for Zhejiang Weixing is consumers upgrading their homes. Despite the slowdown in new property sales, we believe people will still want to carry out home renovations on existing houses and apartments, and demand for Zhejiang Weixing’s products and services should continue to grow. Additionally, its strong brand means that it can charge a premium on its products, so its financials actually look similar to a consumer company's.

We do own one property company in our portfolios. China Resources Land (CR Land) is the 10th largest property developer in China with an attractive portfolio of high-end shopping malls (around 40% of the net asset value). It has a strong balance sheet and its shopping malls have benefitted from the consumption upgrade trend in China. We believe this should continue to be a strong growth driver for the company and took the opportunity to add to our holdings as the valuation became more reasonable.

What is your exposure to industrial and healthcare companies and your rationale for investing in them?

WK: In the healthcare sector, we own pharmacy businesses, independent contract laboratory (ICL) companies, medical device manufacturers and leading pharmaceutical companies. Healthcare spending in China is much lower than in developed countries, and with China’s ageing population we believe that demand for healthcare should remain steady. We are reasonably confident about the long-term investment opportunities in Chinese healthcare, but this is another area that is subject to policy noise.

However, when we talk about healthcare policies, we believe we should look at the impact on specific companies rather than the general policy impact. In the pharmacy sector, the market is highly fragmented — for example, Yifeng Pharmacy, which we consider one of the leading players, has only 2% of the market. Our investment case for Yifeng is based on industry consolidation — we believe as one of China’s leading pharmacies it should gain market share from the weaker ones.

ICL companies have been beneficiaries of Covid-19 as well as the recent policy changes to control overall hospital expenses. Hospitals — especially after Covid-19 — have found it necessary to outsource more services to ICL companies to improve their internal operational efficiencies. In the medical devices sector, we own Shenzhen Mindray, which exports more than 40% to global markets. This overseas exposure should help to diversify against policy risks in the local mask market.

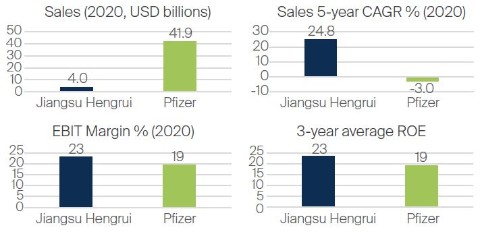

On pharmaceutical companies, we do have some concerns about the short-term negative impact of policy changes, as the prices of drugs have been cut. But as mentioned earlier, if you look at the revenue difference between Pfizer as a leading global pharma company, and Jiangsu Hengrui as the leading pharma company in China (chart below), we are fairly confident that Jiangsu Hengrui will become a much bigger business in the long run. The management has built a solid track record in the last 20 years — we will have to see whether the management can find a way to grow the business further.

Global winners

Jiangsu Hengrui vs. Pfizer (Pharmaceuticals)

CAGR = Compound Annual Growth Rate

EBIT = Earnings Before Interest and Taxes

ROE = Return On Equity

Source: Bloomberg, FSSA Investment Managers, February 2022

ML: We have been focused on industrial automation and automation in general for a number of years now. Although the recent economic slowdown will likely affect demand in the short term, we think this is one of those trends that will last for many years for the simple reason that China is running short of people. Last year for example, was a record-low year for birth rates in China. If you extrapolate the trend, one can easily see that for the next 10 or 20 years, there should be increasing demand for robotic equipment as well as components that can improve efficiencies or improve the production process.

Shenzhen Inovance, which makes automation components, has always intrigued us. We have known Inovance for many years and have a meaningful position in this company. Since the early days, the management has been extremely focused on research and development (R&D). Over the years, they have evolved from elevators into programmable logic circuit (PLC) programs, which is like the “brains” of automation equipment and controllers for electric vehicles. We like the kind of progressive management who are always looking to improve things, and their people are really quite driven.

During Covid, Inovance managed to gain significant market share, not just because their technology was good but because they were still working in factories while their multinational peers were working from home. When multinationals were not able to fulfill their customers’ needs, Inovance came in and swept up market share at a time when China was still relatively intact and global supply chains were disrupted. We do believe that this situation is going to last beyond Covid.

Will the global supply chain disruption impact the companies in the portfolio?

ML: Because of Covid, the whole global supply chain has been heavily disrupted. These days, supply chain management is about calling the right people to make sure that you can find a container box or freightliner coming up from Hong Kong. As a result, there are a lot of goods and services missing along the supply chain and customers may not get what they need.

We think the supply chain is still going to be an issue. But, if anything, it is going to benefit the leaders. There was a period when investors were concerned about labour shortages in China and anti-dumping policies from the US, and companies wanted to diversify their suppliers away from China. I tried to find textile companies or manufacturing facilities in Indonesia, Vietnam and India, but after a while I concluded that there was really no point.

When Apple wants to diversify away from China, we believe what they really want is for Sunny Optical or Luxshare (Chinese component companies) to build a factory for them in India or in Vietnam. Similarly, if Nike wants to diversify, instead of finding a small textiles company in Vietnam or India, they will ask Shenzhou International to do it for them. Around 40% of Shenzhou’s production base is actually in Vietnam.

Additionally, there is a general belief that due to Covid, companies will change the way they think about supply chain management and consider issues not just on cost. Companies are no longer thinking about “just in time” but rather “just in case”. We have seen a number of companies setting up factories in the US and Europe for example, because of anti-dumping clauses and geopolitics. So we do see that as a trend, but we don't necessarily see that as hurting or disadvantaging the industry leaders.

How do you identify Chinese companies with high environmental, social and governance (ESG) standards? How can investors avoid green-washing or relying too much on scores from ESG rating agencies?

WK: As ESG is an integrated part of our investment process we have always paid a lot of attention to these areas. In China, especially in the A-share markets, ESG is still in the early stages, so we have to conduct our research on a bottom-up basis. We look at each company one by one, identify the key ESG issues with each company, and then we engage with companies to encourage the kind of changes we would like to see.

We use data from third-party ratings agencies or consultants as a reference, but these reports often lack sufficient data — especially on the social aspect. It requires us to be more proactive and to engage with companies in order to gain ESG information first-hand.

And there is definitely room for improvement on the quality of information from third parties. For example, we mentioned Zhejiang Weixing earlier. The company produces plastic pipes and under-floor heating. Consultants look at the sector classification and they allocate a “very high” carbon emission score for this company, which means that it is a heavily polluting business. But when we talked to the company, we realised that there were no chemical reactions in its production, and it generates barely any waste water. This kind of insight can only be gained through direct engagement with the company.

Due to the regulatory crackdown on technology companies last year, some investors have lost their confidence. Will the new regulations still allow companies to make huge profits?

HC: It is important for these technology companies to return to their earnings momentum, continue to reinvent themselves and introduce new business lines. We believe this will help investors regain their confidence in these companies.

For example, in the past Tencent created products like WeChat and continually launched new games to drive growth. However, looking forward we believe the cloud business and its focus on ‘2B’1 will likely be the company’s future growth drivers.

For Meituan, the existing businesses are still growing at a reasonable rate, but it has also expanded into new businesses such as online groceries. It probably will go into the physical goods e-commerce space too, which would also help future growth.

For both of these companies and technology companies in general, it really boils down to whether we believe they are the true innovators in society, whether they have the best talent and whether they have the right incentives so that they can continue to create value for investors.

ML: When we first invested in Tencent in 2005, they were setting up a messaging tool called QQ, which was similar to ICQ in the West. Back then we did not expect online retail or e-commerce would happen, but the company has innovated and created new products and business lines including WeChat.

There is a belief that Tencent, among others, are actually quite pro-policy. The management do not come across as being overly aggressive, which is one of the criticisms of technology companies. When the Chinese government announced the “Common Prosperity” goal, Tencent was one of the first companies to set up a common prosperity fund.

We think that Tencent, despite all the challenges, can still grow, but we believe growth for the industry will slow down — whether that is from the regulatory environment, or from the simple fact that it is already on such a large scale.

1 2B is short-hand for “to business”, implying a focus on delivering services to businesses rather than consumers

Do you see the increase in raw materials prices affecting companies in the portfolio?

WK: Concerns about inflation are not a new thing — raw materials prices have increased quite a bit last year because of power shortages and carbon emission controls on the supply side. We are no expert at forecasting the prices of commodities but what we can do is look at a company's capability to manage it.

For example, home appliances companies like Gree Electric and Midea Group suffered from rising prices in copper and plastic last year. These companies are the top two players in the air-conditioning sector in China and they both have strong market positions. Together they control around 70% of the market, so they can pass through the cost pressure to their customers, although it will take a few quarters to do so.

Likewise for Zhejiang Weixing — the major raw material it uses is plastic, which saw rapid price increases last year. However, the company was able to increase its selling prices twice, which eased the cost pressure somewhat.

Ultimately, we try to identify companies with strong competitive advantages in a consolidating sector, so that they can eventually pass through higher costs to consumers.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 10 March 2022 or otherwise noted.

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure. Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication but the information contained in the material may be subject to change thereafter without notice. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material . To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors' portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group (MUFG). Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

This material may not be copied or reproduced in whole or in part, and in any form or by any means circulated without the prior written consent of First Sentier Investors.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:[1]

• Australia and New Zealand by First Sentier Investors (Australia) IM Limited, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

• European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

• Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong

• Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B) is a business division of First Sentier Investors (Singapore).

• Japan by First Sentier Investors (Japan) Limited, authorised and regulated by the Financial Service Agency (Director of Kanto Local Finance Bureau (Registered Financial Institutions) No.2611)

• United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

• United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167).

• Other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (registration number 122512; registered office 23 St. Andrew Square, Edinburgh, EH2 1BB number SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

[1] If the materials will be made available in other locations, seek advice from Regulatory Compliance.

Related

/// Call-to-action component to come ///