This is a financial promotion for FSSA India Subcontinent Strategy. This information is for professional clients only in the UK and elsewhere where lawful. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund's investments and could cause the Fund to defer or suspend redemptions of its shares.

- Indian subcontinent risk: although India has seen rapid economic and structural development, investing there may still involve increased risks of political and governmental intervention, potentially limitations on the allocation of the Fund's capital, and legal, regulatory, economic and other risks including greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities.

- Single country / specific region risk: investing in a single country or specific region may be riskier than investing in a number of different countries or regions. Investing in a larger number of countries or regions helps spread risk.

- Smaller companies risk: Investments in smaller companies may be riskier and more difficult to buy and sell than investments in larger companies.

For details of the firms issuing this information and any funds referred to, please see Terms and Conditions and Important Information.

For a full description of the terms of investment and the risks please see the Prospectus and Key Investor Information Document for each Fund.

If you are in any doubt as to the suitability of our funds for your investment needs, please seek investment advice.

FSSAIM - India - Fund Manager Views - March 2021

As bottom-up investors, the FSSA team carry out well over 1,500 meetings each year to assess company managements’ capabilities and the underlying strength of the franchises they run. These Monthly Manager Views are based on the team’s discussions with company management and the in-depth analysis that follows.

Pricing power

Every company we speak to these days tells us about the cost pressure that they are facing, emanating from rising global commodity prices. Domestic steel prices have risen by 35% y/y, copper by over 50% y/y and palm oil by over 60% y/y through February 2021. Indian corporates are being forced to reckon with sharp increases in input costs for the first time in almost a decade. We believe that pricing power is often the critical litmus test of a franchise’s quality.

Leading consumer staples businesses typically emerge stronger from such periods. Rising agricultural commodity prices drive rural incomes higher and strengthen consumer demand. Category leaders gain market share from their unorganised sector competitors, who struggle to pass on higher costs to consumers. These leaders gain operating leverage as well – their revenue growth accelerates with higher selling prices, while they find ways to cut discretionary costs.

For example, operating profit growth of Hindustan Unilever, the largest fast-moving consumer goods (FMCG) company in India, accelerated during periods of input cost inflation such as FY08 to FY09 and FY11 to FY12. Its management is likely to use the current period of cost inflation to its advantage as well, as its competitive position across categories has strengthened further in recent years. In contrast, the leader in India’s two-wheeler industry, Hero MotoCorp, has typically struggled during periods of high inflation.

Consumers are highly price sensitive in the entry and executive segments in which it is dominant. Hero’s gross margins declined from 31% to 27% over FY06 to FY12 as it passed on only part of the increase in commodity prices during that period. It has raised prices significantly over the last two years after new safety and emission norms were mandated. Its management now faces the difficult choice between protecting its volumes or profitability. We own shares of Bajaj Auto in the portfolio, which will face a similar dilemma for its Indian two-wheeler business; however, over the years it has managed to diversify its business into multiple segments and geographies, and that helps Bajaj to defend its margins better than its competition.

Most of our portfolio companies have high gross margins, which means they have to make a smaller price hike to maintain their profitability compared to companies with lower gross margins. They have also displayed an ability to protect and even improve their profitability in inflationary environments over decades. What is more, these strong franchises come out with higher market shares through the inflationary periods. We are confident that they will achieve similar results in the current period as well.

Godrej Consumer Products

We have been shareholders of Godrej Consumer Products for many years. It has been one of the best consumer companies to own in India over the last two decades, generating an annualised return of 30% for its shareholders. However, the business has struggled in recent years due to a combination of weak consumer demand in each of its markets, as well as missteps by the company. It has appointed new leaders, whose actions suggest a new-found energy to step on the growth pedal and turn around what was not working. We recently spoke to the heads of Godrej Consumer Product’s businesses in each of its key markets – India, Indonesia and Africa.

India is the Group’s key market, contributing 70% of its operating profit. Consumer demand here has been hurt by repeated macroeconomic disruptions (demonetisation, Goods and Services Tax, the non-banking finance companies’ crisis and now Covid). Godrej’s pace of innovation had also slowed in recent years. This appears to be changing. The company has launched new products such as dishwashing liquids, toilet cleaners and floor cleaners, as consumer demand for these categories accelerates. It is also expanding distribution in rural areas and has created dedicated teams to focus on emerging channels like e-commerce. These initiatives indicate a renewed thirst for growth, which was absent in recent years.

Its international businesses have been built through mergers and acquisitions. In Indonesia, Godrej has grown its profits consistently by gaining share in a weak market environment. This steady growth should continue as it expands its footprint in the lucrative general trade channel and enters large new categories like hygiene products. Its foray into Africa, through several acquisitions made over a decade, has been a source of significant disappointment. However, there has been a key change here, as Dharnesh Gordhon, the ex-CEO of Nestle Nigeria, was appointed to lead Godrej’s African business last year. He is driving changes in each aspect of the business, from pricing to distribution, manufacturing and talent recruitment. Dharnesh had successfully led similar changes at Nestle. These initiatives have the potential to drive a multi-fold increase in Godrej Africa’s profits from a depressed base.

Temporary periods of difficulty in inherently strong businesses often provide the most attractive investment opportunities.

Godrej operates in grossly underpenetrated and cash generative categories. The growth that has been missing in recent years is now likely to return. Following these engagements, our conviction in the investment case for our holdings has increased.

The second wave of Covid-19 in India

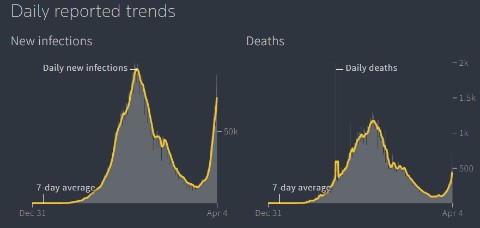

India entered 2021 amidst an environment of optimism. At the beginning of the year, we were hearing about the lives of our friends and family slowly returning to normal, with a steady decline in the active caseload of Covid-19 infections. Some commentators even suggested that India had achieved herd immunity, which now sounds laughable. Consumer demand was also strong across categories. But since mid-February, new Covid-19 cases have surged from approximately 10,000 daily to now more than 93,000 (as at April 4th), similar to its previous peak last September of 98,600 daily cases.

Source: Reuters, as at 4 April 2021: https://graphics.reuters.com/world-coronavirustracker- and-maps/countries-and-territories/india/

The speed of the current surge is worrying – the current increase in the daily caseload from 10,000 to 90,000 cases has taken only half the time it did last year. Fatality rates are likely to rise with a lag as well. However, there are two crucial differences between the two waves of the pandemic. The state of Maharashtra alone accounts for over half of new daily infections and the top five states account for 70%. Due to the high concentration of cases in a few cities and states, containment measures are localised. No large-scale regional or national lockdowns have been announced. The vaccination drive is also accelerating, after the government allowed private medical facilities to participate in the national vaccine program. Over 75 million vaccine doses have now been administered.

Our discussions with portfolio companies have made it clear that they are well-positioned to deal with the impact of the second wave of the virus on their businesses. They set up effective ways for their employees to work remotely and interact with their customers, suppliers and channel partners in the absence of in-person communication, and strengthened their balance sheets during the unprecedented lockdown last year. They emerged from the disruption with stronger market positions. We do not pay too much attention to quarterly results, but we noted that in the quarterly numbers reported through the peak uncertainty of last year our company holdings demonstrated an inherent management and franchise resilience, which has increased our conviction in their ability to deal successfully with the risks emerging from the surge in infections. We would view any decline in share prices arising from the second-wave of Covid-19 as an attractive opportunity to add to our holdings.

Source: First Sentier Investors as at 31 March 2021. The Fund is a sub fund of Ireland domiciled First Sentier Investors Global Umbrella Fund Plc.

Cumulative Performance in USD (%)

Calendar Year Performance in USD (%)

Asset allocation (%)†

Country

Sector

Top 10 company holdings (%)

Related insights

- Article

- 3 mins

- Article

- 4 mins

- Article

- 3 mins

Important Information

This document has been prepared for informational purposes only and is only intended to provide a summary of the subject matter covered and does not purport to be comprehensive. The views expressed are the views of the writer at the time of issue and may change over time. It does not constitute investment advice and/or a recommendation and should not be used as the basis of any investment decision. This document is not an offer document and does not constitute an offer or invitation or investment recommendation to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/ or act on the basis of any material contained in this document.

This document is confidential and must not be copied, reproduced, circulated or transmitted, in whole or in part, and in any form or by any means without our prior written consent. The information contained within this document has been obtained from sources that we believe to be reliable and accurate at the time of issue but no representation or warranty, express or implied, is made as to the fairness, accuracy, or completeness of the information. We do not accept any liability whatsoever for any loss arising directly or indirectly from any use of this information.

References to “we” or “us” are references to First Sentier Investors.

In the UK, issued by First Sentier Investors (UK) Funds Limited which is authorised and regulated by the Financial Conduct Authority (registration number 143359). Registered office Finsbury Circus House, 15 Finsbury Circus, London, EC2M 7EB number 2294743. Outside the UK and the EEA, issued by First Sentier Investors International IM Limited which is authorised and regulated in the UK by the Financial Conduct Authority (registered number 122512). Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB number SCO79063.

Certain funds referred to in this document are identified as sub-funds of First Sentier Investors ICVC, an open ended investment company registered in England and Wales (“OEIC”). Following the UK departure from the European Union, the OEIC has ceased to qualify as a UCITS scheme and is instead an Alternative Investment Fund (“AIF”) for European Union purposes under the terms of the Alternative Investment Fund Managers Directive (2011/61/EU). Accordingly, no marketing activities relating to the OEIC are being carried-out by First Sentier Investors in the European Union (or the additional EEA states) and the OEIC is not available for distribution in those jurisdictions. This document does not constitute an offer or invitation or investment recommendation to distribute or purchase shares in the OEIC in the European Union (or the additional EEA states). Further information is contained in the Prospectus and Key Investor Information Documents of the OEIC which are available free of charge by writing to: Client Services, First Sentier Investors (UK) Funds Limited, PO Box 404, Darlington, DL1 9UZ or by telephoning 0800 587 4141 between 9am and 5pm Monday to Friday or by visiting www.firstsentierinvestors.com. Telephone calls may be recorded. The distribution or purchase of shares in the funds, or entering into an investment agreement with First Sentier Investors may be restricted in certain jurisdictions.

Representative and Paying Agent in Switzerland: The representative and paying agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. Place where the relevant documentation may be obtained: The prospectus, key investor information documents (KIIDs), the instrument of incorporation as well as the annual and semi-annual reports may be obtained free of charge from the representative in Switzerland.

First Sentier Investors entities referred to in this document are part of First Sentier Investors a member of MUFG, a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries do not guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk including loss of income and capital invested.

Copyright © (2021) First Sentier Investors

All rights reserved.