India Fund Manager Views

As bottom-up investors, the FSSA team carry out well over 1,500 meetings each year to assess company managements’ capabilities and the underlying strength of the franchises they run. These Monthly Manager Views are based on the team’s discussions with company management and the in-depth analysis that follows.

Pricing power

Every company we speak to these days tells us about the cost pressure that they are facing, emanating from rising global commodity prices. Domestic steel prices have risen by 35% y/y, copper by over 50% y/y and palm oil by over 60% y/y through February 2021. Indian corporates are being forced to reckon with sharp increases in input costs for the first time in almost a decade. We believe that pricing power is often the critical litmus test of a franchise’s quality.

Leading consumer staples businesses typically emerge stronger from such periods. Rising agricultural commodity prices drive rural incomes higher and strengthen consumer demand. Category leaders gain market share from their unorganised sector competitors, who struggle to pass on higher costs to consumers. These leaders gain operating leverage as well – their revenue growth accelerates with higher selling prices, while they find ways to cut discretionary costs.

For example, operating profit growth of Hindustan Unilever, the largest fast-moving consumer goods (FMCG) company in India, accelerated during periods of input cost inflation such as FY08 to FY09 and FY11 to FY12. Its management is likely to use the current period of cost inflation to its advantage as well, as its competitive position across categories has strengthened further in recent years. In contrast, the leader in India’s two-wheeler industry, Hero MotoCorp, has typically struggled during periods of high inflation.

Consumers are highly price sensitive in the entry and executive segments in which it is dominant. Hero’s gross margins declined from 31% to 27% over FY06 to FY12 as it passed on only part of the increase in commodity prices during that period. It has raised prices significantly over the last two years after new safety and emission norms were mandated. Its management now faces the difficult choice between protecting its volumes or profitability. We own shares of Bajaj Auto in the portfolio, which will face a similar dilemma for its Indian two-wheeler business; however, over the years it has managed to diversify its business into multiple segments and geographies, and that helps Bajaj to defend its margins better than its competition.

Most of our portfolio companies have high gross margins, which means they have to make a smaller price hike to maintain their profitability compared to companies with lower gross margins. They have also displayed an ability to protect and even improve their profitability in inflationary environments over decades. What is more, these strong franchises come out with higher market shares through the inflationary periods. We are confident that they will achieve similar results in the current period as well.

Godrej Consumer Products

We have been shareholders of Godrej Consumer Products for many years. It has been one of the best consumer companies to own in India over the last two decades, generating an annualised return of 30% for its shareholders. However, the business has struggled in recent years due to a combination of weak consumer demand in each of its markets, as well as missteps by the company. It has appointed new leaders, whose actions suggest a new-found energy to step on the growth pedal and turn around what was not working. We recently spoke to the heads of Godrej Consumer Product’s businesses in each of its key markets – India, Indonesia and Africa.

India is the Group’s key market, contributing 70% of its operating profit. Consumer demand here has been hurt by repeated macroeconomic disruptions (demonetisation, Goods and Services Tax, the non-banking finance companies’ crisis and now Covid). Godrej’s pace of innovation had also slowed in recent years. This appears to be changing. The company has launched new products such as dishwashing liquids, toilet cleaners and floor cleaners, as consumer demand for these categories accelerates. It is also expanding distribution in rural areas and has created dedicated teams to focus on emerging channels like e-commerce. These initiatives indicate a renewed thirst for growth, which was absent in recent years.

Its international businesses have been built through mergers and acquisitions. In Indonesia, Godrej has grown its profits consistently by gaining share in a weak market environment. This steady growth should continue as it expands its footprint in the lucrative general trade channel and enters large new categories like hygiene products. Its foray into Africa, through several acquisitions made over a decade, has been a source of significant disappointment. However, there has been a key change here, as Dharnesh Gordhon, the ex-CEO of Nestle Nigeria, was appointed to lead Godrej’s African business last year. He is driving changes in each aspect of the business, from pricing to distribution, manufacturing and talent recruitment. Dharnesh had successfully led similar changes at Nestle. These initiatives have the potential to drive a multi-fold increase in Godrej Africa’s profits from a depressed base.

Temporary periods of difficulty in inherently strong businesses often provide the most attractive investment opportunities.

Godrej operates in grossly underpenetrated and cash generative categories. The growth that has been missing in recent years is now likely to return. Following these engagements, our conviction in the investment case for our holdings has increased.

The second wave of Covid-19 in Ind

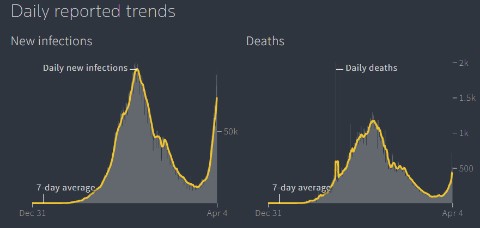

ndia entered 2021 amidst an environment of optimism. At the beginning of the year, we were hearing about the lives of our friends and family slowly returning to normal, with a steady decline in the active caseload of Covid-19 infections. Some commentators even suggested that India had achieved herd immunity, which now sounds laughable. Consumer demand was also strong across categories. But since mid-February, new Covid-19 cases have surged from approximately 10,000 daily to now more than 93,000 (as at April 4th), similar to its previous peak last September of 98,600 daily cases.

Source: Reuters, as at 4 April 2021: https://graphics.reuters.com/world-coronavirustracker- and-maps/countries-and-territories/india/

The speed of the current surge is worrying – the current increase in the daily caseload from 10,000 to 90,000 cases has taken only half the time it did last year. Fatality rates are likely to rise with a lag as well. However, there are two crucial differences between the two waves of the pandemic. The state of Maharashtra alone accounts for over half of new daily infections and the top five states account for 70%. Due to the high concentration of cases in a few cities and states, containment measures are localised. No large-scale regional or national lockdowns have been announced. The vaccination drive is also accelerating, after the government allowed private medical facilities to participate in the national vaccine program. Over 75 million vaccine doses have now been administered.

Our discussions with portfolio companies have made it clear that they are well-positioned to deal with the impact of the second wave of the virus on their businesses. They set up effective ways for their employees to work remotely and interact with their customers, suppliers and channel partners in the absence of in-person communication, and strengthened their balance sheets during the unprecedented lockdown last year. They emerged from the disruption with stronger market positions. We do not pay too much attention to quarterly results, but we noted that in the quarterly numbers reported through the peak uncertainty of last year our company holdings demonstrated an inherent management and franchise resilience, which has increased our conviction in their ability to deal successfully with the risks emerging from the surge in infections. We would view any decline in share prices arising from the second-wave of Covid-19 as an attractive opportunity to add to our holdings.

Top 10 company holdings (%)

Important Information

References to “we” or “us” are references to First Sentier Investors (FSI). The FSSA Investment Managers business forms part of First Sentier Investors, which is a global asset management business that is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

In Hong Kong, this document is issued by First State Investments (Hong Kong) Limited (FSI HK) and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First State Investments (Singapore) (FSIS) whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM).

This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Any opinions expressed in this material are the opinions of the individual authors at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

Please refer to the relevant offering documents in relation to any funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website and should be considered before any investment decision in relation to any such funds.

Neither MUFG, FSI HK, FSIS, FSI AIM nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested.

To the extent permitted by law, no liability is accepted by MUFG, FSI HK, FSIS, FSI AIM nor any of their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that we believe to be accurate and reliable, however neither the MUFG, FSI HK, FSIS, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited 2021

All rights reserved.