China Equities: Back in the doldrums?

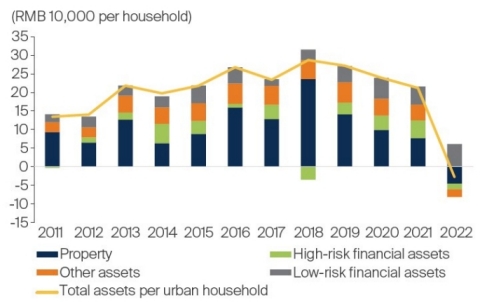

After Chinese stocks rallied upon the abrupt end to pandemic lockdowns in late 2022, pessimism has taken hold of the markets again. This time, concerns include the uneven post-Covid recovery, the lack of stimulus and weak external demand. While we can see robust recoveries in service sectors such as catering, travel and hospitality, the manufacturing and property sectors need more time to revert to their pre-Covid strength. The same goes for consumer confidence, as urban households’ property and financial assets have declined in value while youth unemployment rose above 20%.1

Estimated change in Chinese urban households’ assets

Note: High-risk financial assets include stocks, funds, and trusts; low-risk financial assets include wealth management, deposits, and insurance. Other assets include automobiles, and operating assets such as shops, factories, and equipment.

Source: CICC, FSSA Investment Managers, as at 30 June 2023.

Despite the sluggish recovery, we think the underlying fundamentals of our portfolio holdings remain strong.

Additionally, valuations have become cheaper again, and we see the recent market weakness as a buying opportunity.

MSCI China Index’s price-to-earnings (trailing 12 months and 10-year average)

Source: Factset, FSSA Investment Managers, as at 5 July 2023.

Investing in China’s dynamic market comes with an evolving set of challenges and opportunities. Today, the key challenges include shifts in geopolitics, policy priorities and demographics. In the shorter term, weak consumer confidence and rising unemployment have been additional areas of concern.

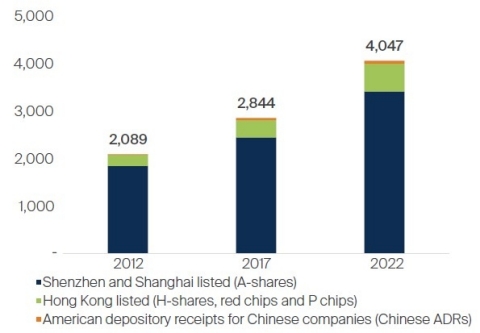

But we also see an attractive opportunity set in a unique market. We have been impressed by the improving quality of Chinese companies and management over the years. In the context of emerging markets, China has a stable government and political order, although its authoritarian nature draws controversy. And as the second largest stock market globally, it is highly regulated and deeply liquid.

Number of listed companies with over USD500m market cap

Source: CLSA, FSSA Investment Managers, as at 30 June 2023.

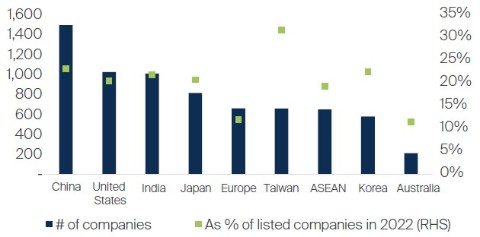

Listed companies which doubled profit after tax (PAT) in last 5 years

Source: CLSA, FSSA Investment Managers, as at 30 June 2023.

Finding growth in a more mature market

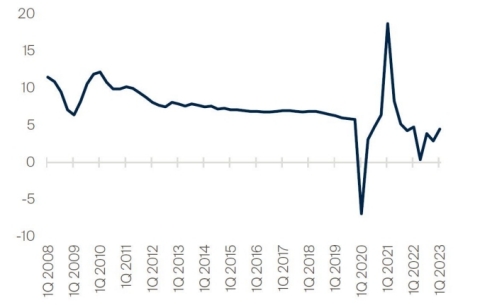

We have heard concerns around China’s slowing economy, including the potential to miss the 5% GDP growth target for 2023. We expect China to deliver steady albeit lower growth than before, given it is a more mature market. In this context, we can still find industry leaders who benefit from gaining market share over weaker rivals, or companies improving their returns and expanding their customer markets.

If we look at some of the most successful companies across the world, like Proctor & Gamble, Estee Lauder and Nestle, their profits do not grow 20-30% every year. Rather, they generate steady profits and reward shareholders with value over the long term. Similarly, we look for companies in China which can generate 10-15% annual growth on a sustainable basis, and have returns on equity (ROE) in the mid-teens or higher.

China’s GDP growth, YoY %

Source: National Bureau of Statistics, Bloomberg as at June 2023.

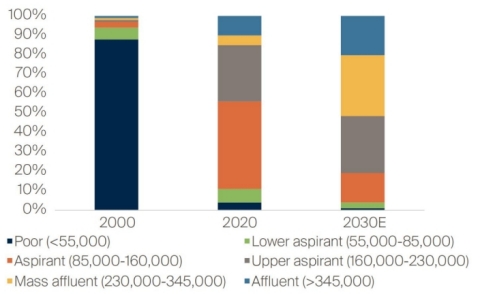

China’s falling birth rate and ageing population are also top-of-mind for the market. But while the Chinese people may be getting older, they are also getting richer. According to Boston Consulting Group, China’s middle class and affluent populations will grow by over 80 million during 2022-30, to account for 40% of the country’s total. The May 2023 study also found Chinese consumers are willing to trade up across many product categories, including fresh & organic foods, health care, personal & home care, electronics, sports gear and beauty products.

In a separate study from 2021, McKinsey forecasted consumers in the upper-middle brackets (those with annual household incomes from RMB160,000 to RMB345,000) will drive 60% of China’s urban consumption by 2030, while the “affluent” segment above them will drive another 20%.

Urban consumption % by income group (Annual household income in RMB, 2020 real)

Source: McKinsey & Company, as at November 2021.

Our China equity strategies are invested in many areas likely to benefit from this structural trend — dominant consumer franchises, such as Anta Sports and Midea Group, amid a growing preference for domestic brands; drugs and medical services companies like CSPC Pharmaceutical and Shenzhen Mindray, which may benefit from rising spend on healthcare; well-managed and conservative banks like China Merchants Bank and Bank of Ningbo which are tapping into the growth in wealth management; and technology champions in niche markets, such as Shenzhen Inovance and Advantech, which may benefit from increasing industrial automation and localised production.

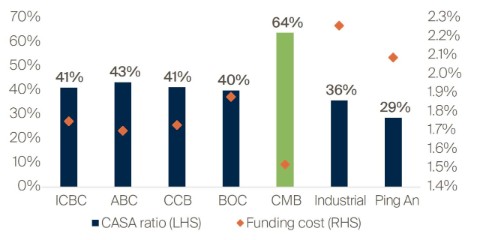

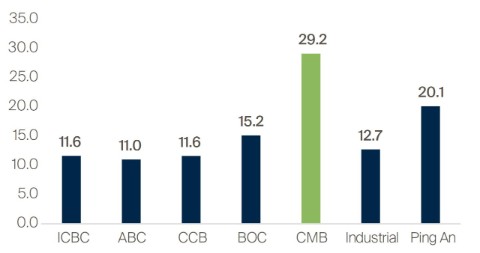

To highlight an example, China Merchants Bank (CMB) was the first joint-stock commercial bank to focus on retail and high-net-worth customers in the early 1990s. Its retail banking business has grown to 184 million customers, with assets under management of more than RMB12 trillion — predominantly from its Sunflower (mass affluent) and private banking customers.

The company plans to continue building its wealth management business and focus on value creation for shareholders and other stakeholders. Despite being controlled by a central state-owned parent, China Merchants Group, it is seen as the most market-oriented bank in China. It also has the highest return on assets (1.4%) and return on equity (18%) in the industry, thanks to its low funding cost, lean business model and strong fee income franchise.

CMB also has a prudent risk management mind-set and the highest coverage ratio in China. Its loan growth has been in line with China’s industry average, but its deposit growth is the highest among all the major banks. Unlike its peers, CMB’s deposits are growing faster than its loans, which means it controlled its loan growth to focus on the quality of lending.

Retail CASA ratio2 and funding cost

Private bank assets under management (AUM) per customer, RMB millions

Source: Company reports, FSSA Investment Managers, as at May 2023.

On the negative side, there are concerns that China’s “common prosperity” drive may slow down the growth of the wealthier population, although we think this is likely priced in. There is also intensifying competition for retail customers, at a time with weak loan demand. Even after China’s reopening, Chinese banks’ net interest margins reached a historical trough in the first quarter, amid the low (and falling) interest rate environment.

The stock has been under pressure for the past year, and we have added to our holdings. Despite the concerns, its wealth management strategy is on track and asset quality remains benign. We believe its strong capital adequacy rate, non-performing loans (NPL) coverage and stable retail business should protect the book value over the next few years.

Mitigating the pitfalls of investing in China

Given the many challenges and pitfalls of investing in China, we think an active, bottom-up approach makes sense. While some investors have been disappointed with the flattish performance of the MSCI China over the past decade, our strategies have provided attractive returns over this period. We think this is due to our focus on quality companies with sustainable and predictable growth, which helps us mitigate two key reasons for the disappointing market performance — a lack of supply discipline and poor quality among many companies.

Lack of supply discipline

For many decades, as China transitioned away from being a centrally planned economy, it experienced frequent overcapacity in sectors such as steel, cement, chemicals, shipbuilding, and solar panels. The causes included excess investments in infrastructure projects, easy access to loans and misaligned incentives, which all led to lower returns for companies and investors.

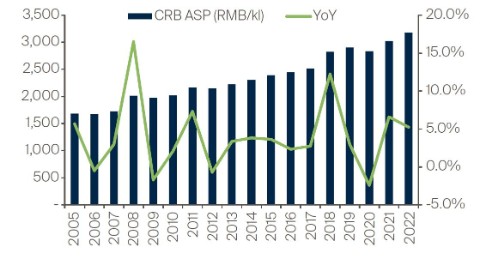

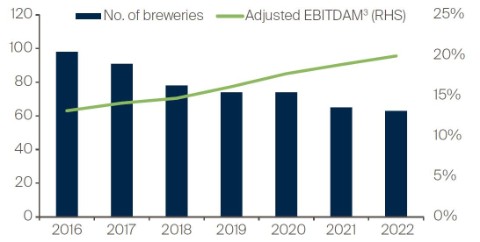

We typically avoid buying companies in such commoditised sectors. In contrast, the Chinese beer market is highly consolidated, with the top three companies sharing 75% of the market. As a result, competition in this industry appears rational and measured. China is different from global markets as domestic beer volumes have been in decline since 2014. As the economy and middle class have grown, so has the demand for premium products. Meanwhile, despite tepid sales, margins and profitability have improved as the leading beer companies consolidated their breweries and modernised their operations.

We hold China Resources Beer (CRB), the largest beer company in China with around 30% market share. CRB’s share of premium sales has grown to just under 20% of turnover, with help from a 2019 merger with Heineken China. Although the company is a State-Owned Enterprise (SOE), China Resources businesses have typically been well run, with returns comparable to private enterprises. The most recent annual report suggests that the company is focused on quality growth and profitability.

Average selling price (ASP) has grown consistently

Operations are being optimised

Source: Company filings, FSSA Investment Managers, as at 30 June 2023.

Poor quality among many companies

When we say a company is poor quality, we are often referring to unattractive economics like persistently low returns and lack of competitive moats like pricing power or strong brands. We also look closely at the leadership’s alignment, culture and track record.

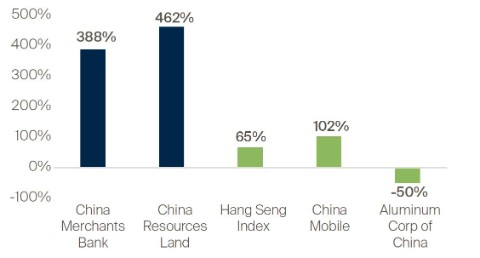

The companies which underperformed often had management who made wrong-footed or sub-optimal investments. Historically China’s SOEs have largely generated subpar returns. One example is Aluminum Corporation of China (CHALCO). When we looked at the company’s capex in the past and the returns on those investments, it was hard to make sense of it.

In contrast, portfolio holdings such as China Resources Land and China Merchants Bank are more market-driven despite being SOEs. For example, CMB differs from China’s big policy banks in a few ways: firstly, it did not inherit legacy staff and was able to build its own staff and culture from scratch, making it more of a meritocracy. Secondly, the bank is not directly owned by the state and doesn’t have one dominant shareholder, resulting in a governance system that is much closer to privately-owned banks in other markets. This explains why CMB has largely managed to avoid national service. Finally, the bank’s culture is very market-oriented. At every level of the organisation, they try to ensure every division is profitable on its own and can generate capital, which is why they have not raised capital in the past decade.

Total returns from January 2007 through June 2023

Source: Bloomberg, FSSA Investment Managers, as at 30 June 2023.

We only invest in companies that have good management, competitive advantages and attractive returns. This is especially important going forward, as China’s heady growth days are mostly over. Hence, companies are shifting their focus to enhancing returns and winning market share with better brands, products and strategies.

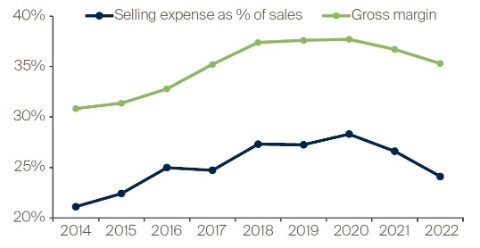

However, we realise that no company is perfect. Despite our strict requirements around quality, sometimes our portfolio companies can make mistakes or miss their targets. A key performance detractor in our portfolio this year has been China Mengniu Dairy, which weakened on concerns about its underlying profitability as its acquisitions of Yashili and Bellamy have not been very successful. Mengniu has booked asset impairments for both acquisitions. Bad timing, misjudgement of sector development and unstable teams in the acquired companies all contributed to this poor outcome.

While the company made some mistakes, our meetings with the management team indicate they are learning and evolving. Recent comments from the CEO suggest that Mengniu will prioritise profitability and cash flow going forward. We believe Mengniu’s fundamentals are in decent shape, though it will need to strengthen its brands, develop more innovative products, and improve its digitalisation platforms to achieve its profitability targets. We still expect Mengniu to benefit from the rising dairy consumption in China, currently growing at a mid-single-digit rate, as it improves in areas such as ice cream and milk powder, and develops newer products such as fresh milk and cheese.

Mengniu’s margin improvements have recently stalled

Source: Factset, Bloomberg and FSSA Investment Managers, as at 30 June 2023.

Portfolio update

In what has been a challenging environment, our strategies have declined year-to-date. We mentioned some of the key detractors, China Merchants Bank and Mengniu Dairy, earlier in this note.

In addition, JD.com’s performance has been weak due to sluggish consumer demand and concern around more promotional activities taking place, which will stall its retail margin expansion. However we think it makes strategic sense to build consumer mindshare on the platform’s value-for-money offering. The company is dominant in standardised categories such as electronics, fast-moving consumer goods (FMCG) and large home appliances, and has also built a significant presence in other categories.

Anta Sports also declined on doubts about China’s recovery and consumer demand. We see rising competition from foreign firms like Nike, which has been aggressive in China’s online market. We remain positive on Anta for its multi-brand portfolio which can appeal to different consumer demands. For example, we see bright prospects for its Amer brand which can cater to mid-to-high income groups, and is building awareness among consumers.

On the positive side, key contributors to performance include semiconductor-related companies such as Taiwan Semiconductor Manufacturing (TSMC), Realtek and Mediatek (the first two are held in our Greater China strategies). This was largely driven by optimism over developments in artificial intelligence (AI), such as the latest ChatGPT software and the projected demand for more powerful chips. Another reason, in our view, is that chip prices had already dropped last year on concerns about the inventory build-up, and so did the share prices. In late 2022, we added to the companies as we believed the valuations had factored in much of the cycle weakness.

The stocks have performed well since that period. TSMC reported an optimistic outlook with a recovery expected in the second half of this year. The management noted signs of stabilisation in demand and expects the inventory correction to bottom out in the coming quarters. Similarly, Realtek and Mediatek guided for sales to recover this year as the cycle turns more positive.

TSMC remains a high-conviction holding in our Greater China strategies, given its strong global franchise as the largest foundry with the most advanced technologies. Although its growth will eventually taper off due to the law of large numbers, for now it should continue to gain market share and outpace the overall industry’s growth. It has demonstrated pricing power amid strong customer demand, which can in turn drive more investments in a virtuous cycle.

We have consolidated our semiconductor holdings after the recent strength, and reduced our position in Realtek, a Taiwanese integrated circuits (IC) designer focused on connectivity chips. It has benefited from the previous two years’ cyclical strength. Its margin profile is not as attractive as its IC designer peers, as the business includes many long-tail consumer connectivity products. Therefore, we think the business model lacks operating leverage and its profits may be more volatile.

As for Mediatek, another IC design company, we have mostly held on to our position. About half of its business comes from smartphones, a maturing end market, with the other half coming from areas like autos, industrials and application-specific integrated circuits (ASICS). Given the company’s size, we don’t expect very fast growth, but the diversification of its business should be a key driver. We also think the valuations are very reasonable, at 15x price-to-earnings and a 10% dividend yield.

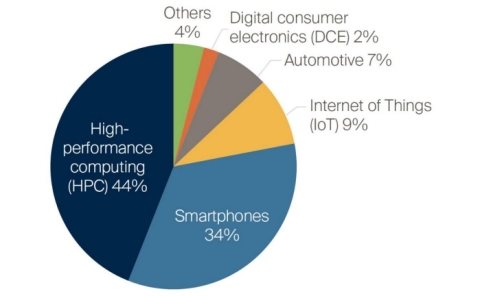

Over the longer term, we expect many beneficiaries from the AI trend, but in the near term the optimism may be a bit overdone. TSMC has been anticipating the AI wave for many years, and high-performance computing has recently become TSMC’s largest revenue source, surpassing smartphones.

TSMC’s revenue by platform, 1Q 2023

Source: Company presentation, as at 20 April 2023.

The industry still needs to clear through excess inventories in the coming months, especially in consumer products which have faced weak demand. Another risk is the added complexity from geopolitics and de-globalisation. For example, TSMC’s expansion into the US is turning out to be harder than expected, due to issues around recruitment and training.

Besides the chipmakers, Netease also rose after the management reiterated its positive outlook for the business. Future revenue growth is expected to be supported by innovative new content and a diversified games portfolio, while existing games should remain steady. It also has plans to expand its overseas presence, launching games outside of China. With a long track record and impressive returns over the past 20 years, we like the company’s strong alignment and mind-set for returning value to shareholders.

Key transactions

Amid the recent headwinds, we have added to many of our key holdings as their valuations became more attractive. In no particular order, these include Tsingtao Brewery, Anta Sports, H World, Yifeng Pharmacy, Wuxi Apptec, Hongfa Technology, JD.com, Mengniu, Sino Biopharmaceutical, Autobio Diagnostics and Midea.

We added more broadly to Haier Smart Home, a leading global home appliances maker with sales evenly split between China and overseas. It is a decent franchise with the top position in refrigerators and washing machines, and the only domestic player with a strong presence in the high-end segment. It is also ahead of peers in terms of overseas expansion, with most of its overseas sales coming from its own brands.

While the company has struggled with low efficiency, suboptimal alignment and weaker margins than peers, recently the home appliance/white goods assets were all combined into one identity with corresponding incentive schemes. We believe this should improve alignment and profitability. A recovery in air conditioners domestically and increasing competitiveness in North America should lift margins in the next five years.

We also bought Kanzhun, the leader in China’s online recruitment industry. It has disrupted the industry with a recommendation-based direct chat model, and has demonstrated superior user engagement and recruitment effectiveness over its peers. We see further potential to gain market share as it taps into underpenetrated areas like small and medium-sized enterprises (SMEs) and blue collar workers. There is also scope to increase the monetisation rate on job postings and candidates.

Finally, we bought a toehold in Bafang Electric, a leading supplier of electric motor systems for pedal assist electric bikes (pedelecs) and electric scooters. We like the focused and aligned management team (who altogether hold around 65% stake in the company), as well as its long-term growth potential. While near-term the industry is in a down-cycle after having peaked during Covid, we believe Bafang will benefit from rising penetration of e-bikes in the US and China (from below 10% and 5% respectively), and market share gains in Europe. Based on Japan’s 40% penetration rate, we think Bafang could also benefit from China’s ageing population.

Conclusion

In response to the recent pessimism in the market, we revisited China’s long-term investment case and how we think about the key opportunities. The demographic tailwinds may be less robust than before, but we still see room for industry leaders to deliver attractive returns in a more mature economy with a growing middle class.

Considering the broader China market’s mediocre returns over the past decade, we believe our active management approach with bottom-up stock selection makes sense. We continue to seek absolute returns by investing in portfolios that are concentrated and benchmark agnostic, while our focus on quality and the long term sets us apart from our peers. Finally, we stand by our belief that the best time to buy is when things appear gloomy and valuations are undemanding.

We welcome any feedback. As always, thank you for your support.

1 Source: National Bureau of Statistics, Bloomberg, as at 15 June 2023.

2 CASA ratio stands for current and savings account ratio, it is the ratio of deposits in current, and saving accounts to total deposits.

3 EBITDA is the earnings before interest, taxes, depreciation, and amortization.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at June 2023 or otherwise noted.

Important Information

References to “we” or “us” are references to First Sentier Investors (FSI). The FSSA Investment Managers business forms part of First Sentier Investors, which is a global asset management business that is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited (FSI HK) and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) (FSIS) whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM).

This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Any opinions expressed in this material are the opinions of the individual authors at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

Please refer to the relevant offering documents in relation to any funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website and should be considered before any investment decision in relation to any such funds.

Neither MUFG, FSI HK, FSIS, FSI AIM nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested.

To the extent permitted by law, no liability is accepted by MUFG, FSI HK, FSIS, FSI AIM nor any of their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that we believe to be accurate and reliable, however neither the MUFG, FSI HK, FSIS, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited 2023

All rights reserved.