Management quality: how we identify teams built to last

At FSSA Investment Managers, we invest in businesses we expect to be part of our portfolio for decades to come. That’s why we put such a premium on the quality of management teams, choosing leaders who we believe have the skills to build strong franchises and deliver long-term growth.

The emerging market landscape was very different when the FSSA team first started investing in the late 1980s1.

In the wake of the Asian financial crisis of 1997, the region was seen as risky. It was essential to carry out extensive due diligence into businesses and the people who ran them. As investors, we needed to ensure we could trust them to guide their firms into the future.

Competitive advantages, financial fundamentals, company valuations and the size of the market opportunity naturally had their roles to play in stock selection.

But we found management quality was just as significant a factor when it came to choosing companies to invest in – and we remain firm in this belief. While a company’s financials and franchise strength are of course hugely important, without the right people to guide the business, we would not invest.

Our commitment to carrying out in-depth, in-person research into companies has given us a key advantage and, we believe, helped to deliver sustained growth for our clients.

Our evaluation process

Our unwavering focus on management quality is far from typical in emerging-market investing.

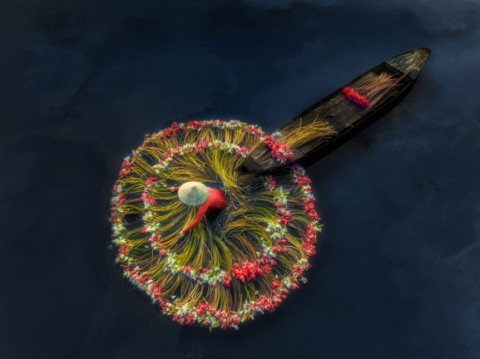

We put in the time and go the distance. Our portfolio managers regularly travel to destinations around the globe to meet management teams face-to-face, directly in the places they do business.

This represents a key step in our process of understanding how companies operate and identifying the leadership teams capable of turning promising business models into long-term success.

What we look for in management teams

We’re looking for a sense of stewardship. Does this leadership team consistently ‘do the right thing’, not just for themselves but for other stakeholders? How do they treat minority shareholders, or employees?

Management’s past performance, especially during downturns and more challenging trading conditions, makes up a significant proportion of our analysis. Our in-person experience helps us fill the gaps in our initial research and understand how the company has adapted to the external environment, as well as whether it has taken any shortcuts to reach its current position.

With a portfolio of, at most, 45 businesses, the FSSA Global Emerging Markets strategy rejects far more companies than we move forward with. If we encounter certain red flags in terms of governance or a history of misdemeanours, for example, we will move on to other opportunities.

No matter how compelling the growth opportunity or the current valuation, we simply will not invest unless we have faith in management and their ability to sustain the business through the cycles.

Fostering ongoing relationships

Our assessment of management quality does not end the moment we make our initial investment. As long-term, patient investors, FSSA Investment Managers seek to establish long-term partnerships with investee businesses.

We believe we have a useful role to play in providing support and promoting growth as emerging markets continue to develop in areas such as corporate governance and sustainability disclosure. We regularly engage with firms on topics such as capital allocation and board diversity, and share best practices across our portfolio companies.

As the emerging market landscape evolves, our ethos remains the same. It has served us and our clients well, and consistently enabled us to partner with companies we believe will be the long-term winners.

1 FSSA Investment Managers has a long history of investing in Asia Pacific and Global Emerging Market equities as part of the former Stewart Ivory & Company Limited, which subsequently became known as First State Stewart. After years of organic growth, the team split in two in 2015 and First State Stewart Asia was formed. We subsequently renamed the team FSSA Investment Managers in 2019.

Related articles

Many fund managers see high trading volumes and rapid portfolio turnover as evidence of constant re-evaluation and attention to detail. But the FSSA Global Emerging Markets (GEM) strategy favors a more patient, long-term approach, only investing in companies where we have high conviction in their prospects.

- Article

- 4 mins

Investors sometimes fixate on macro movements such as short-term economic trends such as inflation paths and interest-rate movements, but this is not the FSSA Investment Managers way. Our strategy is driven by long-term growth trends in emerging markets and the investment opportunities they create.

- Article

- 4 mins

At FSSA Investment Managers, we take a patient, long-term approach when investing in global emerging markets, with a concentrated portfolio of high- quality companies. We examine why this philosophy has endured for the past quarter-century.

- Article

- 4 mins

High-turnover, high-volume strategies might rely on algorithms and AI for their trading ideas. But at FSSA Investment Managers, we believe the key to building conviction in our investment ideas is having face-to-face conversations with the people and companies we invest in.

- Article

- 4 mins

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Group, a global asset management business. First Sentier Group is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. References to “we” or “us” are references to First Sentier Group. Some of our investment teams use the trading names First Sentier Investors, FSSA Investment Managers, Stewart Investors, Albacore Capital, Igneo Infrastructure Partners and RQI Investors. Not all brands are available in all jurisdictions or to all audiences. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its Australian website.

This material is directed at persons who are wholesale investors or wholesale clients (as defined under the Corporations Act 2001 (Cth) (Australia) or Financial Markets Conduct Act 2013 (New Zealand)) and is not intended for persons who are retail clients. This material is general information only. It does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. The information in the material does not constitute an offer of, or an invitation to purchase or subscribe for any securities.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Group.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities mentioned herein may or may not form part of the holdings of a First Sentier Group portfolio at a certain point in time, and the holdings may change over time.

We have taken reasonable care to ensure that this material is accurate, current, complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information has been calculated gross or net of management fees (where indicated) and net of transaction costs. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Group, 2025

All rights reserved.