Finding the silver lining in Asia Pacific markets

Fund Manager Q&A - September 2022

How is the FSSA Asian Growth portfolio positioned in light of the challenging market environment?

Firstly, we should note that we are agnostic about indexes. What we're interested in is the underlying economic interest, rather than country or arbitrary sector classifications. For example, we own Nippon Paint, which is listed in Japan but is the biggest paint company in China.

We also think that sector classifications can be misleading. Companies like Jardine Matheson and Jardine Cycle & Carriage, or Mahindra & Mahindra, are considered Industrials by MSCI, but we would argue that they are really driven by consumption dynamics.

Our exposure to Financials is about the same as in previous years. Technology has come down, by design. We have reduced our positions in Mediatek and Taiwan Semiconductor (TSMC). We still think they are good companies, but they have done extremely well in the last few years.

We have also reduced platform companies JD.com and Tencent. Again, they performed for years, but looking forward we think the biggest issue is the rate of growth versus the valuation.

A large part of our remaining technology holdings are the boring-but-predictable IT services businesses. Through Covid, you can clearly see the tech-intensification of our lives. Every business needs technology solutions, from end-to-end logistics right through to store layouts and the apps on peoples’ phones.

This has benefited portfolio holdings Tata Consultancy Services (TCS), Tech Mahindra and Cognizant. They are global businesses though they are listed in India. We think they have extremely resilient growth profiles.

Our Greater China exposure looks lower than the index, but in terms of economic interest, we would include Japanese companies Shiseido and Fanuc here, as their businesses are dominated by China sales, and Nippon Paint, discussed earlier.

At the margin, we've added to Southeast Asia. It is a challenging region, in terms of growth and finding bigger-sized businesses, but in terms of the “China plus one” strategy and the valuations versus the opportunities, we have found some attractive companies there.

Overall, the portfolio is relatively concentrated with 40 to 50 names. The top 10 holdings form around 42% of the portfolio while the top 20 makes up 70%. As long-term investors, our holdings are fairly consistent – if you looked at the top holdings three or five years ago, it wouldn't look very different from today.

What is the impact of higher inflation on the portfolio?

In general, equities struggle in a high inflation environment because interest rates have to go up – higher cap rates mean lower price-to-earnings (P/E) multiples. In the past, 20x used to be expensive; and then interest rates went to zero and a P/E of 30x was not unreasonable.

In times like these, one has to be more sensible in terms of absolute valuations versus rates of growth. We think about the margin structure of the business and ensure that the gross margin is much higher than the market, as it means the ability to absorb price increases. With low gross margin businesses, a small increase in input prices can erase a large amount of profit.

We have invested in businesses with pricing power and strong franchises – beer companies for instance, or consumer companies in general, or brand companies – they can change the product or the packaging, or push through higher prices.

The other point is to avoid debt, and Asian companies in general have strong balance sheets. Our portfolio companies are well capitalised and many have net cash. This hasn't mattered so much in the last 5-10 years, but with rising interest rates it will matter more in the future.

How does your investment style fare in the current environment?

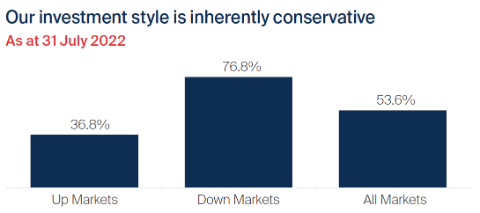

Our investment style is inherently conservative, which means that we tend to perform better in down-markets. In Asia and global emerging markets (GEM), where there is the overlay of currency and regulatory policy risks to worry about, the down-drafts can be rather swift.

Therefore, we think it is important to limit the drawdown. If we can preserve capital in more adverse conditions, over time we should perform reasonably well as we're investing in a high-growth part of the world. We would expect to deliver high-single to low-double-digit absolute returns per year.

When markets are trend extrapolating, as they have been in the last few years, it can be an effort to keep up. But in down-markets, having a high active share is where we really differentiate ourselves.

Source: First Sentier Investors. Performance data is calculated on a gross of fees basis and includes income reinvested net of withholding tax. Months of outperformance vs benchmark (MSCI AC Asia ex Japan Index).

How important is company engagement as part of your process?

We have always been on the front foot in terms of ESG1. But you could say we look at it back to front – we think that governance is the key necessary and enabling factor, because with poor governance, you could lose everything.

The social aspect is interesting and quite often overlooked. We believe that how a business treats its staff and customers; how it responds to customer issues; whether it pays tax – these are the things from which you can learn about a company’s culture.

As outside minority investors we meet with management and try to ask the right questions, then we benchmark what they say they do against how they actually behave.

With that in mind, company engagement is a very important part of our process. It’s not about trying to persuade people to do what we think they should do. But we have our views and what is most interesting to us is how they respond (whether positively or negatively).

Does FSSA’s focus on the quality of management matter as much to performance as it did 10 or 20 years ago?

Businesses are run by people; and coming back to our earlier point – if the governance is poor and the people are not aligned with you as a shareholder but are actively on the other side, then with malfeasance you can lose money really quickly.

One of the key things we can do to guard against governance issues is not to go down the quality curve. The temptation is always there – if this business is trading on 30x, which is quite expensive, and here is one on 15x, you think you can buy it at half the price. But of course there is usually something wrong with it, in terms of the people or the governance.

With slowing growth and rising unemployment in China, how does this affect the outlook for Chinese consumer companies?

The obvious answer is “badly”, if you read the headlines. Our contrarian view is to be constructive as the tide had gone out and we thought there could be some interesting opportunities.

The market has fallen by a lot, but it started at such high levels that it is still not particularly attractive today. Investing in China is predicated on high rates of growth, but there is a huge gap between growth forecasts and what is actually happening on the ground.

There's an expectation that China’s growth will rebound in the second half of the year, but it's difficult to see that happening. Given all the changes, the regulatory risks, the property sector slowdown and the long period of high growth China has had, we think it likely that private companies will grow more slowly and there will be some margin pressure. It could remain tough for a while.

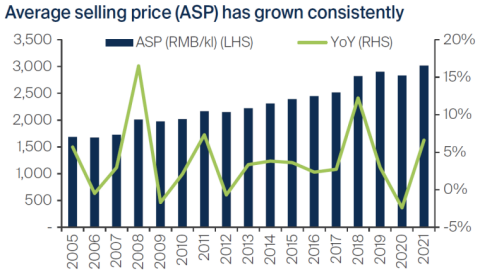

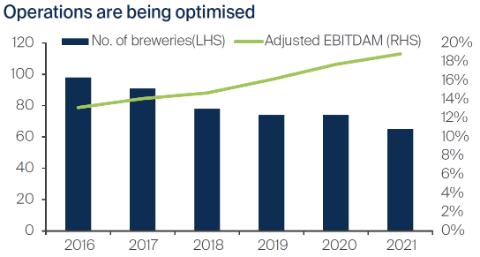

On the other hand, from a bottom-up perspective we thought China Resources Beer (CR Beer) looked interesting. It is the largest brewery in China by market share. We think beer is a resilient business, it is premiumising and there’s potential for consolidation. Though CR Beer still wasn’t cheap, it had fallen by a third and was more reasonably priced.

Heineken, perhaps the world’s most successful emerging market brewery, have folded their business and brands into CR Beer and are now a 20% shareholder in the overall group. We have been invested alongside Heineken for many years in Malaysia, Indonesia and historically in Singapore, and know the business well.

In China the pricing per unit of beer is one of the lowest in the world. China is the biggest beer market in the world. Over time we would expect higher prices and further concentration of the market. CR Beer has around 60 breweries so there are plenty of opportunities for consolidation, both in terms of brands and efficiency.

Source: Company filings, FSSA Investment Managers. As at 30 June 2022.

While you are heavily underweight China, what kind of companies do you still have confidence in?

Firstly, we don’t think about portfolio construction in terms of “underweights” or “overweights”. Our asset allocation is purely the result of our bottom-up stock selection, and that depends on what we think about companies in terms of quality and earnings growth.

That said, I don't think our exposure to China is particularly low. If you include AIA Group in Hong Kong, the technology companies in Taiwan, and the Japan-listed companies mentioned earlier, the economic exposure to China is not insignificant. In Asia it’s difficult to be positioned otherwise – China is a significant generator of regional (and global) demand and wealth.

There are still many businesses in China that we like – CR Beer, mentioned earlier, as well as China Mengniu Dairy, one of the biggest yoghurt, milk and dairy companies in China. China Mengniu has a P/E valuation in the high-teens and the management are committed to improving margins. The market has become more rational too, competition-wise, which should help.

We also like Midea Group, which is primarily an air-conditioning and home appliance business, but the group is increasingly diversifying into other capital goods, with 40% exports. It is trading on a P/E of 10x and has a net cash balance sheet and sensible management.

These are resilient businesses. Even though the economic environment is challenging, we believe they should come out better than their peers and gain market share through this period.

What are your thoughts about the underlying leverage and risks in China’s real estate sector?

There are some interesting statistics and comparisons on China’s real estate sector. The country’s debt levels and the value of property in household balance sheets is extraordinarily high – two to three times what would be normal around the rest of the world and comparable with Japan in ’89. (Japan experienced a huge asset price bubble in the ‘80s, which subsequently burst and resulted in the economic stagnation that the country is still battling today.)

Then there’s the debate about investment versus the consumption side of the economy. If investment is maxed out at around 45% of GDP, how do you drive GDP growth constructively from here? Exports are doing great, but it's only 2-3% of the economy2 and there are limits in terms of the weak external environment, as well as political resistance. The Chinese economy needs to rebalance; but the household balance sheet is overstretched with property, prices are falling and activity is moribund.

Some investors are optimistic about another big stimulus from the government – if it can get close to 300% debt-to-GDP, why can't it be 350%? But the problem with property developers is that they don't do anything else. The risks inherent in those business models are extremely high. Some, like China Resources Land, have investment properties, shopping malls and cashflow to cover its dividend and debt; but many others are purely developers.

So the answer is, we don't know, but we are cautious on the property sector. We don't necessarily see an implosion, with companies collapsing and the clearing process leading to a crash in asset prices. We think it will correct in a “left pocket, right pocket” way, through local governments and state-owned enterprises (SOEs).

On the Chinese banks – just like Citibank in the global financial crisis (GFC), while it never went bust, if you were a shareholder in 2008, in terms of the dilution and the capital calls, it wasn't a good equity investment. Similarly, we think the risk of a wipe-out from Chinese real estate and the financial sector is very small, but that doesn't make it a good investment.

What do you think about India-specific risks and most importantly, is it too expensive?

We still think India is a wonderful place to invest in terms of quality, persistency of profitability and returns. Barriers to entry are high, so businesses can do well for a long time.

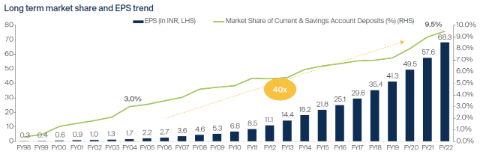

We have owned the Indian private banks, HDFC Bank for example, for a long time; and they have become cheaper than history. They got through Covid much better than expected, and their returns on equity (ROEs), as well as the runway of growth and the increasing financialisation in India, means that valuations still look attractive.

Source: Source: Company filings, FSSA Investment Managers. As at 30 June 2022.

Valuations in the Indian consumer sector are harder to justify. Hindustan Unilever and Nestlé are good businesses, with high ROEs, good persistency and fantastic track records. But their valuations are very demanding. We are mindful of the risks and have taken profits on these and other expensively-valued companies.

Vietnam has done very well in the last two decades. What is your view on its future growth?

Like most investors, we are optimistic about the prospects in Vietnam. There is clearly strong growth in manufacturing with “China plus one” but the challenge is finding good quality companies. In many cases, the governance is not up to the mark or companies are too small.

We have direct exposure to Vietnam through Vinamilk, which is the largest dairy company in the country. It is reasonably valued and has a strong franchise. It’s owned by the government as well as Jardine Matheson and other private investors, and it's been run like a private company for the last three decades, thanks to the CEO’s stewardship.

The other exposure to Vietnam is through Jardine Cycle & Carriage as a shareholder in one of the largest private companies in Vietnam. THACO, which assembles and distributes multiple auto brands, is dominant, local and well run – just like Astra in Indonesia, many years ago.

To what extent will a strong US dollar backdrop impact the Asia Pacific market? Do you expect stronger capital inflows to the region?

Generally speaking, a strong US dollar is painful for emerging markets, there is a lot of US dollar borrowing floating around Asia. It is perhaps not a systemic threat, but China property companies for example have large amounts of US dollar debt and some of them are on the waterline already.

It is interesting to see China cut rates when the rest of the world is increasing them, which means a weaker Chinese currency. Inflation in China is low, for now, as the economy has stalled – but this may change if growth picks up.

I actually see capital exiting emerging markets. The asset class really flies when everything is wonderful and money is fed into the more marginal segments of emerging markets – and then the opposite happens.

We’ve started to see it already, in the TAM-type3 valuations of companies with no earnings. The contraction in share prices has been significant, with 50% being just the starting point. So, that's where it starts and then it will come to the core.

What keeps you up most at night?

Every day in the newspapers, there are new worries and concerns to think about. I made a joke once: “Worrying definitely works, because 90% of what I worry about never happens.”

More specifically, there are a couple of things I worry about. First, I think we are moving from the age of economics to an age of politics. We've had an incredible 20-30 years of the neoliberal triumph of economics, while politics has been relegated to the background. This has been a massive positive tailwind for equities.

That is clearly changing. I believe we are moving into a more ideological and political age and, particularly in Asia, politicians are reaching directly into businesses with policy changes.

Second, we are moving from the age of capital to an age of labour. Profit, in terms of capital as a share of GDP has increased for the last 20-30 years versus labour’s share. And it's reached a point where, in economies broadly, the age-old social contract is fracturing. As individuals, maybe that is not such a bad thing. But as investors, I think it may be harder to generate the returns that we're used to.

Then there are the fiscal deficits associated with governments, higher taxation, strikes, labour, energy and oil prices. There is plenty to worry about. On the other hand, I think the point to make is that we should keep on analysing companies and not worry too much. As long as we invest in decent businesses run by good people, that still seems to be one of the best ways to protect wealth and deliver attractive absolute returns over time, whatever happens.

1 Environmental, social and governance

2 Source: GDP contribution breakdown from China’s National Bureau of Statistics. Latest full year figures (2021).

3 Estimates of a large and growing “Total Addressable Market – TAM” for a business are often used to justify sky-high valuations, despite the company having no reported earnings.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at 31 July 2022 or otherwise noted.

Adapted from a live webcast in September 2022.

Important Information

References to “we” or “us” are references to First Sentier Investors (FSI). The FSSA Investment Managers business forms part of First Sentier Investors, which is a global asset management business that is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

This material has been prepared by Winston Ke, Portfolio Manager, FSSA Investment Managers (Author). Any opinions expressed in this material are the opinions of the Author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

In Hong Kong, this document is issued by First Sentier Investors (Hong Kong) Limited (FSI HK) and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First Sentier Investors (Singapore) (FSIS) whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM).

This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Any opinions expressed in this material are the opinions of the individual authors at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

Please refer to the relevant offering documents in relation to any funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website and should be considered before any investment decision in relation to any such funds.

Neither MUFG, FSI HK, FSIS, FSI AIM nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested.

To the extent permitted by law, no liability is accepted by MUFG, FSI HK, FSIS, FSI AIM nor any of their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that we believe to be accurate and reliable, however neither the MUFG, FSI HK, FSIS, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited 2022

All rights reserved.